EPA AIM Act | Why ‘Waiting for EPA Relief’ is a Dangerous Gamble for HVAC & Refrigeration Equipment Owners and Operators

Table of Contents

ToggleThe Dangerous Narrative

Over the past 24 hours, I’ve heard the same story from three different operators:

“We’re holding off on compliance investments because EPA is reconsidering the rules and FMI is suing. Why spend money now when the requirements might change?”

This narrative is spreading through industry groups, trade associations, and informal networks. It’s compelling because it offers hope for relief from expensive compliance mandates.

It’s also dangerously wrong.

What “Pending” Actually Means

When people say regulations are “pending adjustment”, they’re referring to two specific legal actions.

I had a conversation last week with a facilities director who told me, “We’re holding off on compliance spending because the FMI lawsuit is going to change everything.”

When I asked him what he thought the lawsuit would change, he said, “You know… the deadlines. Maybe the requirements. I heard they’re pushing everything back to 2030.”

This is the narrative spreading through our industry right now, and it’s based on a fundamental misunderstanding of what’s actually “pending” and what it means for your operations.

Let me break down what’s really happening: not as a lawyer, but as someone who’s spent 30+ years in facilities management watching these regulatory battles play out.

The FMI Lawsuit: What’s Really Being Challenged (And What Isn’t)

Here’s the story

The Food Marketing Institute (the same folks who represent grocery chains and have real influence in Washington) filed a lawsuit in the D.C. Circuit Court challenging specific aspects of EPA’s Technology Transitions program.

Not the whole thing. Not the Subsection (h) leak repair rules. Specific equipment timelines and GWP limits.

What FMI is arguing

“EPA, you’re moving too fast on equipment replacements. Supermarkets can’t replace their refrigeration racks by January 1, 2027. We need more time. And these GWP limits are too strict: let us use refrigerants with GWP up to 300 instead of forcing us to ultra-low-GWP options.”

What FMI wants if they win

- Small store exemptions – Stores under 25,000 square feet get a pass

- 3-year extension – Push the deadline from January 1, 2027, to January 1, 2030

- Higher GWP limits – Allow refrigerants with GWP ≤300 (instead of current stricter limits)

Now here’s where operators are getting confused:

They hear “FMI lawsuit challenges EPA refrigerant rules” and think: “Great! That means I don’t have to worry about refrigerant compliance until this gets sorted out.”

That’s wrong. Here’s why:

The FMI lawsuit affects maybe 20% of your compliance obligations

Let me paint you a picture of what a typical multi-site operator faces on January 1, 2026:

Your refrigeration rack (2,000 lbs of R-404A)

- ✅ Technology Transitions says you can’t install NEW racks with high-GWP refrigerants after Jan 1, 2027

- ✅ FMI lawsuit challenges this deadline

- ✅ If FMI wins: You might get until Jan 1, 2030, to replace

This is what FMI is fighting for.

But that same rack also faces

- ❌ 15 lb leak threshold (Subsection h) – NOT challenged by FMI

- ❌ 30-day repair deadline if leak rate exceeds 20% – NOT challenged

- ❌ ALDS requirement (≥1,500 lbs) – NOT challenged

- ❌ 12-month verification for repairs – NOT challenged

- ❌ Enhanced documentation for every refrigerant event – NOT challenged

- ❌ HFC allocation step-down (2026: 30% reduction) – NOT challenged, STATUTORY LAW

- ❌ Label and Tagging Required

→ Read More on How To Asset Tag Your Store in 3 Hours Instead of 3 Days?

The math

FMI’s lawsuit might give you 3 more years to replace equipment. But it does NOTHING for the leak detection, repair, documentation, and allocation requirements that hit in 20 days.

Here’s the part that really matters for your operations

Even if FMI wins everything they’re asking for (and legal experts I’ve talked to put the odds at 30-50%), here’s what happens:

🛑 Don’t Gamble with the EPA AIM Act

Scenario: FMI Wins Completely

Timeline

- Today: December 12, 2025

- Oral arguments: February-March 2026 (estimated)

- Court decision: June-August 2026 (optimistic)

- EPA implementation: September-November 2026

What you gain

- Ability to install equipment with refrigerants GWP ≤300 (instead of stricter limits)

- Extension to January 1, 2030, for supermarket rack replacements

What you DON’T gain

- Nothing changes for equipment already in place (you still need leak detection and repair)

- Nothing changes for documentation requirements

- Nothing changes for the 15 lb threshold expansion

- Nothing changes for AC/HVAC coverage (that’s Subsection h, not Technology Transitions)

- Nothing changes for the 2026 HFC allocation reduction that starts January 1

Here’s the kicker

By the time the court rules (Q2-Q3 2026), you’ll have already needed to:

- Document 6 months of refrigerant events (Jan-Jun 2026)

- Install ALDS on new equipment ≥1,500 lbs (Jan 1, 2026 deadline)

- Begin 30-day/14-day leak repair compliance

- Start 12-month verification periods for any leaks repaired

- Face the 2026 HFC allocation reduction (30% less virgin refrigerant available)

So yes, you might get more time to replace supermarket racks. But you’ll be 6-9 months into the new compliance regime by the time you find out.

The EPA Reconsideration Petition: Even Less Relief Than You Think

In October 2025, various industry groups (not just FMI, but multiple players) submitted a formal petition asking EPA to reconsider specific aspects of the Technology Transitions rule.

Here’s what they’re asking for:

Request #1: Delay the Remote Condensing Unit Deadline

Current deadline

January 1, 2026 (20 days from now) Industry request: Push to January 1, 2027 (12-month delay)

What this covers

New remote condensing units for walk-in coolers and display cases

The problem operators are missing

This deadline is in 20 days. Even if EPA granted the full extension tomorrow (they won’t), you’ve already made your procurement decisions for Q1 2026.

Equipment has 12-18 month lead times. If you’re installing equipment in February 2026, you ordered it in summer 2025.

The likelihood EPA granting this

Very low. They published the final rule knowing this deadline was tight. To grant relief now – 20 days before the deadline – would essentially admit the rule was flawed from the start. That’s not happening.

Request #2: Extend the Supermarket Rack Deadline

Current deadline

January 1, 2027 (385 days from now) Industry request: Push to July 1, 2028 (18-month extension)

What this covers

New supermarket refrigeration racks ≥200 lbs

The reality operators are ignoring

Even if EPA grants the full 18 months, you need to order equipment NOW. Here’s why:

Supermarket rack procurement timeline

- Engineering/spec: 2-3 months

- Vendor quotes/selection: 1-2 months

- Manufacturing: 12-18 months

- Installation: 4-8 weeks

Total: 15-24 months from decision to operational

If you wait for EPA’s response (March 2026 expected), then wait for potential extension (July 2028), you have 28 months. Barely enough time even if everything goes perfectly.

And here’s what changes even if the extension is granted: Nothing about leak detection, documentation, or allocation requirements.

Request #3: Technical Clarifications

What industry wants

- Clearer definition of “light commercial” (exemption from requirements)

- Better sell-through provisions (how long can pre-manufactured equipment be installed)

- Various technical definitions

What this means for your operations

Essentially nothing. These are edge cases that affect maybe 5% of equipment decisions.

🛑 Don’t Gamble with the EPA AIM Act

So What’s the Real Story Here?

Let me tell you what I’ve seen happen three times in my 30+ years in this industry:

California ARB R3 (2010s)

Industry challenged the timeline. “Regulations too aggressive, technology not ready.” Courts mostly sided with regulators. Operators who waited scrambled in panic at the last minute.

EPA Section 608 expansion (1990s)

The industry asked for delays and exemptions. Got minor adjustments, but core requirements stood. Operators who prepared early had smooth transitions. Operators who waited paid emergency prices for rushed compliance.

Now – AIM Act (2020s)

Same pattern. FMI and others are challenging timelines, asking for relief. Maybe they get 6-18 months. Maybe they don’t.

But the core requirements; leak detection, documentation, allocation step-down; those are happening regardless.

Here’s what’s really at stake

You have two groups of operators right now:

Group A: “We’re waiting for the lawsuit.”

- Not tagging equipment

- Not setting up documentation systems

- Not installing ALDS

- Not planning for allocation reduction

- Banking on relief that might not come, or might come too late to help

Group B: “We’re proceeding as if deadlines hold.”

- Tagging equipment now

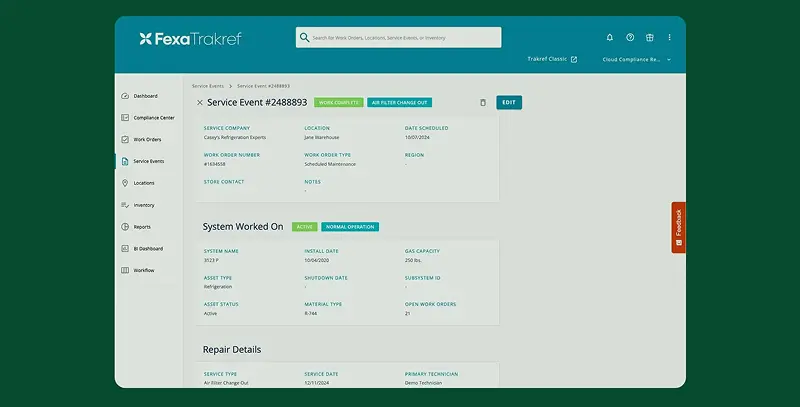

- Implementing Trakref

- Installing ALDS at priority sites

- Planning for 2026 allocation reduction

- Recognizing that even the best-case lawsuit outcome doesn’t eliminate core compliance obligations

Which group faces a lower risk? Which group faces a lower cost?

What “Pending” Actually Means (Spoiler: Not What You Think)

When your colleague says, “The regulations are pending,” here’s what they probably mean: “Someone filed a lawsuit, so maybe we’ll get relief, so maybe we can wait.”

Here’s what “pending” actually means in legal terms:

FMI Lawsuit Status: “Pending”

- Meaning: Filed, oral arguments not yet scheduled

- Timeline: Decision in Q2-Q3 2026 (estimated)

- Probability of success: 30-50% (based on similar cases)

- Scope if successful: Specific equipment timelines only

- Impact on January 1, 2026, requirements: Zero

EPA Reconsideration Petition Status: “Pending”

- Impact on core leak detection/documentation: Zero

- Meaning: Submitted, under agency review

- Timeline: Response in March 2026 (estimated)

- Probability of full relief: 40-60% (EPA often grants some accommodation)

- Scope if successful: Minor timeline adjustments (6-18 months max)

Translation

“Pending” means “we asked for changes and we’re waiting to hear back.” It does NOT mean:

- ❌ Deadlines are suspended

- ❌ Requirements are on hold

- ❌ You can delay compliance with impunity

- ❌ Relief is likely or certain

- ❌ Core obligations will change

It means: Someone filed paperwork. That’s it.

The Part Nobody Talks About: Even Maximum Relief Doesn’t Help Much

Let’s play out the absolute best-case scenario for operators hoping for relief:

Fantasy Best Case

- FMI wins everything (3-year extension, higher GWP limits, small store exemptions)

- EPA grants all reconsideration requests (12-18 months’ delays)

- Both happen quickly (decisions by March 2026)

What you gained

- Supermarket racks: Install by Jan 1, 2030, instead of Jan 1, 2027 (3 extra years)

- Remote condensing: Install by Jan 1, 2027, instead of Jan 1, 2026 (1 extra year)

- GWP limits: Can use R-449A (GWP 1,397) instead of forced ultra-low-GWP

What you DIDN’T gain

- Still face AC/HVAC expansion to 15 lb threshold – Happens Jan 1, 2026

- Still need leak detection (ALDS) for systems ≥1,500 lbs – Required Jan 1, 2026

- Still need 30-day/14-day leak repair – Required Jan 1, 2026

- Still need 12-month verification – Required Jan 1, 2026

- Still need documentation for every refrigerant event – Required Jan 1, 2026

- Still face HFC allocation reduction – 30% reduction happens Jan 1, 2026

🛑 Don’t Let the HFC Phase-Down Catch Your Business Off Guard

The uncomfortable truth

Even if you “win” the lawsuit and petition, you still need 80% of the same compliance infrastructure. You still need Tag Wizard to identify equipment. You still need Trakref to document refrigerant events. You still need ALDS for large systems. You still need leak repair procedures.

📌 All you gained was 6-36 months more time before you’re forced to replace equipment.

But you’re still spending the $778k-$803k Year 1 compliance investment. You’re still implementing the documentation systems. You’re still training your staff.

The lawsuit and petition fight over the easy part: when to replace equipment (that’s just capital budget timing).

They don’t touch the hard part: the operational changes to how you manage refrigerant day-to-day (that requires culture change, system implementation, and ongoing discipline).

So What Should You Actually Do?

Stop waiting for relief that might not come, might come too late, or might not matter.

Start building compliance infrastructure now

- Tag your equipment: You need to know what you have, regardless of lawsuit outcomes

- Implement documentation: Required Jan 1, 202,6 no matter what

- Install ALDS: Required Jan 1, 2026 for new equipment, Jan 1, 2027 for existing

- Plan for allocation reduction: 2026 reduction is statutory law, no lawsuit can change it

Think of lawsuit/petition outcomes as upside, not base case

- Base case planning: All deadlines hold as published

- Upside case: Court/EPA grants 6-18 months on equipment replacement timing

- Bonus: You havea compliance infrastructure in place either way

The operators who will thrive in 2026 and beyond

They’re not waiting. They’re not gambling on relief. They’re building the systems that will be required regardless of legal outcomes. They’re getting ahead of the January 1 deadline.

They’re positioning themselves to take advantage of any relief that comes (because if you get an extension, it’s only valuable if you have time to use it – and that requires preparation now).

The operators who will struggle

They’re in Group A. They’re waiting. They’re banking on the narrative that “everything is pending.” They’re going to wake up on January 2, 2026 and realize that 80% of compliance obligations just took effect regardless of the lawsuit.

They’re going to scramble. They’re going to pay emergency prices. They’re going to face enforcement exposure.

Which group are you in?

The Scalpel vs. The Sledgehammer: What Can Actually Change

Here’s what operators misunderstand: The petitions request scalpel adjustments to specific deadlines. They do NOT challenge the core regulatory framework.

What’s Being Challenged (The Scalpel)

Technology Transitions Timelines for specific equipment types

- Remote condensing units: Jan 1, 2026, deadline (20 days away)

- Supermarket racks ≥200 lbs: Jan 1, 2027 deadline

- Maybe 6-18 months of relief for SOME equipment

Technical Definitions

- Clarifications, not exemptions

- What counts as “light commercial”

- Sell-through provisions for pre-manufactured equipment

What’s NOT Being Challenged (The Sledgehammer That’s Coming Regardless):

EPA Subsection (h) – Leak Detection and Repair

- Status: FINAL RULE (effective January 1, 2026)

- NOT subject to petition or lawsuit

- Statutory mandate under AIM Act § 103(h)

Requirements

- 15 lb threshold (was 50 lbs)

- 30-day federal / 14-day state repair deadlines

- ALDS for equipment ≥1,500 lbs (Jan 1, 2026 for new installations)

- 12-month verification testing

- Enhanced recordkeeping (3 years)

→ Zero chance of change. This is federal law.

Smaller System Coverage Expansion

- Equipment 15-50 lbs now covered (was exempt)

- AC/HVAC systems included (comfort cooling)

- This is the 5% → 79% expansion

- Not subject to petition

→ This is happening. 20 days away.

HFC Allocation Step-Down

- Market access to high-GWP refrigerants shrinking

- 2025: 60% of baseline

- 2026: 40% of baseline

- 2029-2033: 15% of baseline (reclaimed only)

Statutory mandate under AIM Act § 103(b)

→ Supply is tightening regardless of court cases.

State Requirements (CA/NY/WA)

- California SB 253: 100% refrigerant reporting (no de minimis)

- New York Part 494: Mandatory reclamation

- Washington WAC 173-443: State-level HFC restrictions

State law, not subject to federal relief

→ States enforce independently.

California SB 261 vs. SB 253 Confusion

- SB 261: Climate risk disclosure – under legal challenge, delayed

- SB 253: GHG emissions reporting (including refrigerant) – NOT challenged, fully in effect

Deadline: August 10, 2026 (first report)

→ SB 253 is happening. The lawsuit is against SB 261 only.

🛑 Waiting for relief is a dangerous and costly strategy.

The Math That Doesn’t Change

Even in the absolute best-case scenario where FMI wins everything and EPA grants maximum relief:

Best-Case Timeline Relief

- Supermarket deadline: Jan 1, 2027 → July 1, 2028 (18 months)

- That’s still only 931 days from today

- Equipment lead times: 12-18 months

- You’d still need to order equipment in Q1 2026

❌ What Doesn’t Change Even With Maximum Relief

- Subsection (h) leak repair requirements (15 lbs, 30-day deadline)

- ALDS requirements for equipment ≥1,500 lbs

- Expanded coverage of 15-50 lb equipment

- AC/HVAC systems now included

- HFC allocation step-down (supply tightening)

- State requirements (CA, NY, WA)

- Equipment <15 lbs still subject to SB 253 in California

Why Operators Are Wrong to Wait

Myth #1: “EPA is reconsidering everything.”

Reality: EPA is considering 6-18 month timeline adjustments for 2-3 specific equipment types. The entire regulatory framework (Subsection h, smaller systems, ALDS, state requirements) remains fully intact.

Myth #2: “The lawsuit will stop this.”

Reality: The FMI lawsuit challenges Technology Transitions deadlines only. Even if FMI wins (30-50% chance), you get maybe 18 months of relief on forced replacement. Everything else happens on January 1, 2026.

Myth #3: “We can wait to see what happens.”

Reality:

- Remote condensing deadline in 20 days (Jan 1, 2026)

- EPA won’t respond to the petition until March 2026 at the earliest

- Court decision not until Q2-Q3 2026

- Equipment lead times are 12-18 months

Waiting means you’re already behind

Myth #4: “The SB 261 lawsuit affects SB 253.”

Reality: These are TWO DIFFERENT LAWS:

- SB 261 (climate risk) – challenged, delayed

- SB 253 (emissions reporting, including refrigerant) – NOT challenged, fully enforceable, first report due August 10, 2026

Both SB 261 and SB 253 are examples of climate disclosure laws enacted in California, each with different scopes and requirements for businesses.

What’s Happening in 20 Days (January 1, 2026)

Regardless of petitions, lawsuits, or industry hopes, these requirements take effect:

✅ Federal EPA (Subsection h)

- 15 lb threshold – Equipment 15-50 lbs now covered

- 30-day repair deadline (14 days CA/NY/WA)

- ALDS required for NEW installations ≥1,500 lbs

- 12-month verification after repair

- Enhanced recordkeeping (3 years)

- AC/HVAC coverage – Comfort cooling systems included

✅ Technology Transitions (Also January 1, 2026)

- Remote condensing units – Must use GWP ≤150 refrigerants (R-404A, R-507A prohibited)

- Equipment labeling – New installations must show compliance

- Annual reporting – First report due 2027 for 2026 activity

✅ State Requirements

- California SB 261 – Climate risk disclosure due (20 days)

- New York Part 494 – HFC restrictions and reclamation requirements

- Washington WAC 173-443 – State-level HFC restrictions

These requirements apply specifically to covered entities and reporting entities as defined by the respective state laws, meaning businesses that meet certain revenue thresholds, operate in these states, or are otherwise designated must comply with the relevant climate disclosure and HFC regulations.

None of these are subject to the petitions or lawsuits being discussed.

The Real Risk: Non-Compliance Penalties

While operators wait for relief that may never come, the penalties are real: administrative penalties may be imposed for non-compliance, including submitting an inadequate or insufficient report that fails to meet regulatory standards.

EPA Penalties (Subsection h)

- Base penalty: $51,570 per violation per day

- 300-location portfolio, 1,000 systems:

- Failure to calculate leak rates: $1.1M-$3.65M

- Exceeding leak threshold without repair: $1.8M-$5.4M

- No verification testing: $300K-$1M

- Recordkeeping failures: $1.6M-$6.4M

Technology Transitions Penalties

- Non-compliant installations: $10K-$30K per system per day

- 300-location portfolio: 40 installations × $10K × 180 days = $720K minimum

California SB 253 Penalties

- Failure to report: Up to $500K per violation

- Inaccurate reporting: Additional penalties + third-party audit failure (2027+)

These penalties start accruing on January 1, 2026 – regardless of pending petitions.

The Hidden Risk: Installing Last-Generation Refrigerants

While operators wait for “relief,” many are continuing to install R-404A, R-507A, and other high-GWP refrigerants without considering long-term access. This is perhaps the most expensive mistake operators can make.

📌 We are actively working with grocery chains, restaurant groups, Data Centers, and cold storage operators, and understand the January 1 deadline pressure.

The HFC Allocation Step-Down is Statutory Law

- 2025: 60% of baseline (current)

- 2026: 40% of baseline (30% reduction from today)

- 2029-2033: 15% of baseline (reclaimed only)

- This was written by Congress in the AIM Act (Public Law 116-260)

- EPA cannot change these numbers (only Congress can rewrite the law)

- Not subject to petitions, lawsuits, or administrative relief

What This Means for Equipment Installed Today

Installing R-404A equipment in December 2025:

- 2026: 30% less virgin refrigerant available (40% vs. 60% baseline)

- 2029: Only reclaimed R-404A available (85% reduction)

- 2030+: Spot market prices $150-$300/lb (vs. $40-$75 today)

Result: Equipment with a 15-20 year design life faces refrigerant shortages by year 3-4

The Math Operators Miss

“We’ll wait for the lawsuit outcome, then decide what to install.”

- FMI decision: Q2-Q3 2026 (6-9 months)

- Best case: Extension to Jan 1, 2030, for GWP ≤300 refrigerants

Meanwhile, 2026 allocation drops 30%, 2029 drops to 15%

Problem: Even if you get permission to install R-404A through 2030, you won’t have affordable access to R-404A after 2029

Equipment installed TODAY with R-404A/R-507A

- Year 1-3 (2025-2028): Virgin refrigerant available but prices rising

- Year 4-8 (2029-2033): Reclaimed only, severe shortages, $150-$300/lb spot prices

- Year 9-15 (2034-2040): Refrigerant increasingly unavailable at any price

Stranded asset: Equipment becomes unserviceable before the end of its useful life

The Congressional Lock

Unlike EPA regulations, which can be adjusted through petitions or revised rules:

- HFC allocation step-down is statutory (codified in Public Law 116-260)

- Requires Congressional action to change (House vote + Senate vote + Presidential signature)

- Probability of Congressional reversal: <5% (bipartisan climate law)

- Timeline, even if attempted: 2-3 years minimum for legislative process

What Smart Operators Understand

“The lawsuit is about WHEN we must replace equipment. The allocation step-down determines WHETHER we’ll have affordable refrigerant for the equipment we install today. The lawsuit might buy us 18 months. The allocation step-down affects the next 15 years.”

🛑 The EPA AIM Act is here. Waiting for relief is a dangerous gamble.

The Compliance vs. Obsolescence Decision

Option A: Wait for lawsuit, install R-404A if extension granted

- Pro: Maybe 18 more months to replace equipment

- Con: Installing refrigerants trending toward obsolescence

- Risk: Equipment becomes unserviceable by 2029 when reclaimed-only kicks in

Stranded capital: $50k-$150k per system in premature replacement

Option B: Transition now to low-GWP refrigerants

- Pro: 15-20 year refrigerant availability secured

- Pro: Compliance with all scenarios (relief or no relief)

- Pro: Avoid 2029 reclaimed-only shortage

Future-proof: Equipment serviceable throughout useful life.

The Financial Reality

Equipment installed with R-404A today:

- Capital cost: $50K-$150K per system

- Expected life: 15-20 years

- Refrigerant availability: 4-8 years (2029 reclaimed-only)

Replacement needed: 2029-2033 (years 4-8 of equipment life)

Stranded capital: 60-75% of equipment value

Equipment installed with compliant refrigerants today:

- Capital cost: $50l-$150k per system (similar)

- Expected life: 15-20 years

- Refrigerant availability: 15-20+ years (low-GWP future-proofed)

Replacement needed: End of useful life

Stranded capital: $0

The “Wait for Relief” Risk

Operators waiting for FMI lawsuit outcome (Q2-Q3 2026) before making equipment decisions:

- 6-9 months of delay in procurement

- Meanwhile: 2026 allocation drops 30%

- Meanwhile: Prices rise $40-$75/lb → $60-$100/lb

- Meanwhile: Lead times extend 12-18 months → 18-24 months

Result: By the time the lawsuit settles, even if you “win” the right to install R-404A, you face:

- Higher refrigerant costs

- Longer lead times

- Only 3-4 years until reclaimed-only (2029)

- Premature replacement costs in 2029-2033

Congressional Reality Check

The AIM Act passed with bipartisan support in December 2020:

- House vote: 359-53 (87% approval)

- Senate: Included in must-pass spending bill

- Signed by President Trump

- Sponsors included Republicans and Democrats

- Industry supported the framework

Probability of Congressional reversal

- Political will: <5% (bipartisan climate law with industry support)

- Legislative process: 2-3 years minimum

- Practical timeline: Any change wouldn’t take effect until 2027-2028 at the earliest

- 2029 allocation drop: Will happen regardless

What This Means for Equipment Decisions Today

Even in the absolute best case, where:

- FMI wins complete victory (3-year extension + higher GWP limits)

- Congress passes new legislation reversing the allocation step-down

- The President signs it into law

Timeline

- FMI decision: Q2-Q3 2026

- Congressional action: 2027-2028 (if attempted)

- Effective date: 2028-2029

- Meanwhile: 2029 allocation drop already in statute

You’re still betting on equipment installed in 2025-2026 on uncertain legislative outcomes 3-4 years away.

What Smart Operators Are Doing Right Now

The operators who will survive this regulatory convergence understand a critical principle:

“Hope is not a strategy. We plan for deadlines as written, and treat any relief as a bonus.”

Immediate Actions (Q4 2025 – Now):

Equipment Inventory (Tag Wizard Deployment)

- Tag ALL equipment ≥15 lbs (federal requirement)

- Tag ALL equipment with ANY refrigerant (SB 253 requirement if CA-covered)

- Generate a complete asset inventory

📌 Cost: $107K for 300 locations – Timeline: 8 months to complete

Tracking System Implementation (Trakref)

- Deploy a central refrigerant tracking platform

- Integrate with equipment inventory

- Enable leak rate calculations, verification tracking

📌 Cost: $75K-$100K Year 1 – Timeline: 2 months to operational

ALDS Installation (AKO Monitoring)

- Install automatic leak detection on equipment ≥1,500 lbs

- 90 locations with priority equipment = 180 devices

📌 Cost: $396K installed – Timeline: 3-5 months for full deployment

Procurement Planning (Replacement Equipment)

- Identify equipment requiring forced replacement (R-404A, R-507A)

- Order compliant refrigerants and systems NOW

- Assume Jan 1, 2027, deadline (387 days)

- Equipment lead times: 12-18 months

📌 Total Investment: $778K-$803K Year 1 vs. Penalty Exposure: $4.3M-$28.1M over 3 years

The Strategic Message for Leadership

If you’re in a position to influence compliance decisions at your organization, here’s what you need to communicate:

To Your Executive Team

“The petitions and lawsuits address specific timeline adjustments – mostly around forced equipment replacement deadlines. They do NOT affect the core leak detection, system coverage, and state reporting requirements taking effect January 1, 2026. Waiting for relief is gambling with $4-28M in penalty exposure to potentially save a few months on equipment replacement timelines. The math doesn’t support delay.”

To Your Board

“We’re proceeding as if all deadlines hold while monitoring legal developments. Any relief granted would be scheduled relief, not cost relief – we’d still need the same equipment and systems, just with slightly more time to install. Given 12-18 month equipment lead times, procurement must start now regardless of petition outcomes. Delaying puts us at material financial risk.”

To Your Operations Team

“Tag everything. Track everything. Install ALDS where required. The core requirements are not subject to the legal challenges currently pending. Focus on Subsection (h) compliance – that’s federal law effective January 1, 2026, with zero probability of change.”

Understanding “Scalpel” vs. “Sledgehammer” Adjustments

The Scalpel (What MAY Change):

- 6-18 month timeline relief for 2-3 specific equipment types

- Technical clarifications on definitions and procedures

- Sell-through provisions for pre-manufactured equipment

→ This affects WHEN you must replace specific equipment

The Sledgehammer (What WILL NOT Change):

- 15 lb threshold – Smaller systems now covered

- AC/HVAC inclusion – Comfort cooling systems regulated

- Leak detection and repair – 30-day deadline, ALDS requirements

- HFC allocation – Supply tightening to 15% of baseline by 2029

- State requirements – CA/NY/WA independent enforcement

- SB 253 reporting – 100% refrigerant tracking in California

→ This affects WHETHER your systems are covered and HOW you must manage them

The sledgehammer impacts are 10-20x larger than the scalpel adjustments.

The California Confusion: SB 253 vs. SB 261

This deserves special attention because it’s a major source of misinformation:

California’s SB 253 and SB 261 are often confused, but they are separate climate disclosure laws with distinct requirements and compliance obligations.

Both laws are part of a broader effort to address climate change and increase transparency around climate-related financial risks and greenhouse gas emissions for large companies operating in California.

Key aspects of these climate disclosure laws include the application to any business entity, including a limited liability company, business entity formed, or other business entity, that meets the revenue threshold of more than $500 million in total annual revenues (measured in million United States dollars), including annual revenue and California revenue, from the prior fiscal year.

Companies subject to these laws must make climate-related financial disclosures, including reporting on climate-related financial risks, climate risks, and material climate-related risks, as well as the impact of supply chains and value chains on their emissions and risk profiles.

Required disclosures must be made according to a recognized reporting framework, such as the Greenhouse Gas Protocol, Greenhouse Gas Protocol Standards, or an equivalent reporting requirement (including those from the International Sustainability Standards Board or other international reporting requirements).

Emissions data, including greenhouse gas emissions, must be reported for the relevant reporting year and the prior fiscal year.

The reporting entity must publicly disclose the report prepared, ensuring that reports satisfy the requirements of the California Air Resources Board (CARB) and may require an assurance report, reasonable assurance, or limited assurance, depending on the scope of the disclosures.

CARB posted draft regulations and implementing regulations, and the California governor Gavin Newsom signed these laws, with the California Air Resources Board, other governmental entities, and the national government involved in oversight, enforcement, and the adoption of regulations.

The laws encourage voluntary disclosures for other stakeholders, including investors and the public, and require companies to align with international reporting requirements and adopt regulations as they evolve.

A task force is involved in developing and updating the regulations, and companies are expected to make good faith efforts and have a reasonable basis for their initial reports and ongoing compliance.

Accurate reporting timelines and emissions data are essential for informed decisions by stakeholders, and companies must consider consumer demand, financial risks, and competitive advantage in their climate strategies.

Failure to submit a sufficient report or an inadequate or insufficient report may result in administrative penalties or enforcement actions.

All required disclosures must be met to ensure compliance and avoid penalties.

SB 261 (Climate Risk Disclosure) – CHALLENGED:

- Requires climate-related financial risk disclosures (TCFD framework)

- U.S. Chamber of Commerce lawsuit filed

- The court granted a preliminary injunction

Status: Delayed pending litigation

SB 253 (GHG Emissions Reporting) – NOT CHALLENGED:

- Requires Scope 1, 2, and 3 emissions reporting

- Refrigerant emissions are Scope 1

- 100% reporting – ALL equipment, no 15 lb threshold

- First report due August 10, 2026

Status: Fully enforceable, no legal challenge

The court action against SB 261 does NOT affect SB 253.

If your company does business in California (>$610K CA sales) with >$1B revenue, you must report ALL refrigerant emissions from ALL locations nationwide. The SB 261 lawsuit doesn’t change this.

❌ What “Pending” Doesn’t Mean

Let’s be crystal clear about what “pending” legal actions are:

- Do NOT suspend current deadlines

- Do NOT exempt you from compliance

- Do NOT reduce penalty exposure

- Do NOT eliminate reporting requirements

- Do NOT change the 15 lb threshold

- Do NOT exclude AC/HVAC systems

- Do NOT affect state requirements

- Do NOT stop HFC allocation step-down

“Pending” means a request has been filed. It does NOT mean relief is coming, and it certainly does not mean you can wait.

The Bottom Line

The industry narrative that “we can wait for EPA relief” is based on three fundamental misunderstandings:

Scope Confusion

Thinking the petitions challenge the entire regulatory framework, when they only address specific equipment replacement timelines

Probability Misassessment

Assuming relief is certain, when legal experts give it 30-50% odds at best.

Timeline Denial

Ignoring that even maximum relief only buys 6-18 months, and equipment lead times require action now, regardless

The vast majority of compliance requirements (leak detection, smaller system coverage, AC/HVAC inclusion, state requirements, and HFC supply restrictions) are not subject to any pending legal action and will take effect in 20 days.

Waiting for relief that affects 20% of requirements while ignoring the 80% that’s coming regardless is not a strategy. It’s hoping.

And hope is not a compliance plan.

To-dos

If you’re responsible for refrigerant compliance at your organization:

✅ To-dos this Week

- Stop telling your team to wait for EPA relief

- Read the actual Subsection (h) final rule (not industry summaries)

- Understand what’s challenged (Technology Transitions timelines) vs. what’s not (everything else)

- Clarify SB 253 vs. SB 261 with your California counsel

✅ To-dos this Month

- Begin equipment tagging (Tag Wizard or equivalent)

- Deploy tracking system (Trakref or equivalent)

- Identify ALDS installation requirements

- Start procurement planning for replacement equipment

✅ To-dos this Quarter

- Complete equipment inventory at priority locations

- Install ALDS at locations with equipment ≥1,500 lbs

- Order replacement equipment, assuminga Jan 1, 202,7 deadline

- Establish California SB 253 reporting process

The operators who act now have a 3-6 month head start on those waiting for relief that may never come.

Conclusion

The scalpel adjustments being discussed (6-18 month timeline extensions for specific equipment) are real possibilities. They may provide some breathing room on forced equipment replacement schedules.

But the sledgehammer requirements – 15 lb threshold, AC/HVAC inclusion, leak detection, ALDS, state programs, and supply restrictions – are not subject to these legal challenges and will take effect on January 1, 202,6 regardless of petition outcomes.

Betting your compliance strategy on winning a 30-50% probability scalpel adjustment while ignoring the 100% probability sledgehammer requirements is not risk management. It’s gambling.

Smart operators understand the difference. They’re implementing tracking systems, tagging equipment, and installing ALDS now. They’re treating any timeline relief as a bonus, not a dependency.