Double Materiality and Refrigerant Risk: How CSRD, SB 219, and TCFD Are Reshaping Compliance, Strategy, and Investment in 2025

Table of Contents

ToggleWhat Is Double Materiality?

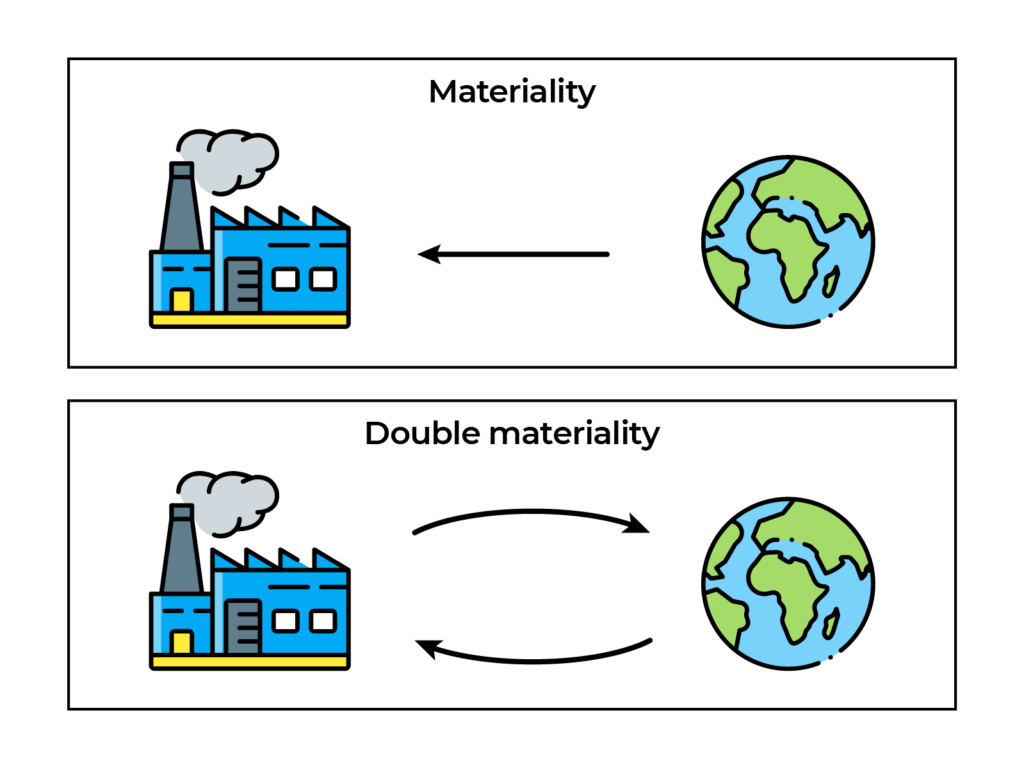

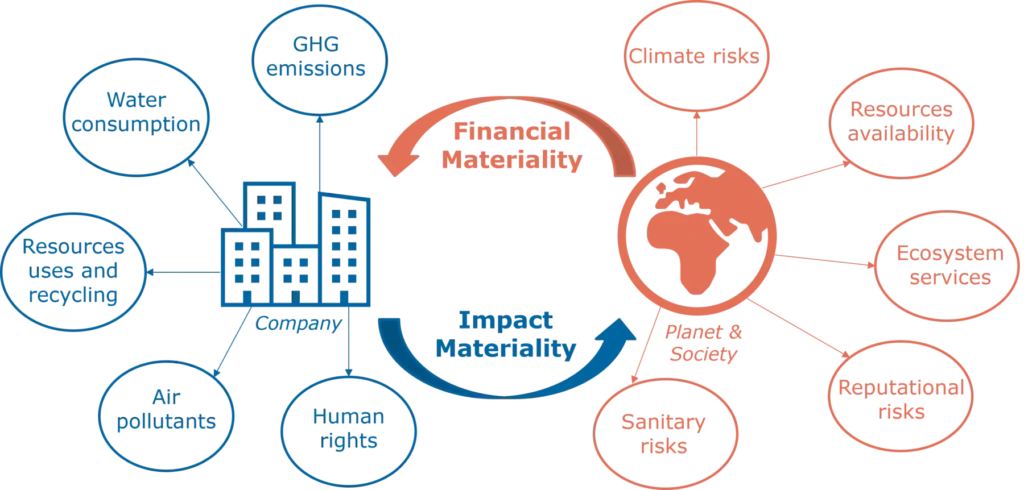

Double Materiality is a climate and carbon accounting lens that expands the traditional definition of materiality.

Historically, financial materiality centered on information relevant to investors’ economic decisions—what directly affects a company’s bottom line.

But in a carbon-constrained world, that’s no longer enough. Double materiality builds on that foundation by requiring disclosure of how climate and ESG risks impact the company and how the company impacts people, the planet, and long-term sustainability systems.

Double materiality doesn’t just inform reporting, it changes it. It integrates environmental and social impacts into financial disclosure frameworks, making them unavoidable in executive and board-level decision-making.

This dual perspective lies at the heart of evolving ESG regulation, especially in the European Union. But the implications go far beyond Europe.

Double materiality is no longer an academic term for U.S.-based companies with operations, subsidiaries, or value chain exposure in Europe, or subject to emerging climate risk rules in California and other states. It’s becoming an operational requirement.

Refrigerants: A Direct Line to Scope 1 Emissions and Double Materiality under the Greenhouse Gas Protocol

We can not overstate the importance of air conditioners, AC units, and refrigeration in the global economy. They preserve food, enable digital infrastructure, protect public health, and support global supply chains. But they also come with a cost, often hidden in fugitive refrigerant emissions.

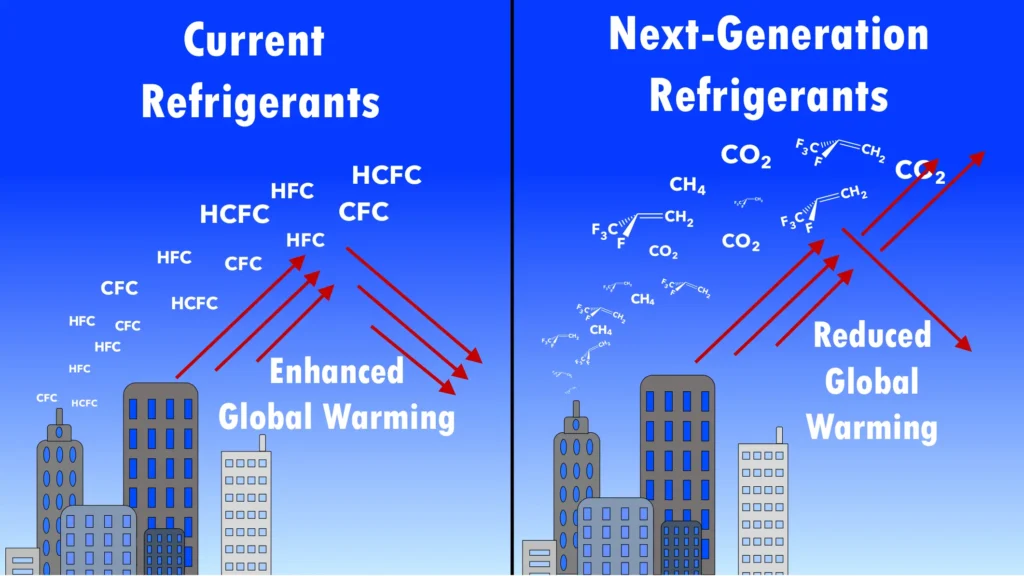

Two of the most common refrigerants in the current generation of cooling systems carry a substantial Global Warming Potential (GWP):

- R-404A (used in commercial refrigeration): GWP of 3,936

- R-410A (used in comfort cooling/AC): GWP of 2,100

AC refrigerant plays a crucial role in the efficiency and safety of an AC system, and using the correct type is essential for optimal performance.

These are Scope 1 emissions (direct emissions from owned or controlled sources), and they fall squarely under the category of fugitive emissions as defined by the Greenhouse Gas Protocol and required in disclosures aligned with the Corporate Sustainability Reporting Directive (CSRD), SB 219, and TCFD.

Fugitive emissions result from unintended leaks, servicing, or disposal of refrigeration and air conditioning systems.

📌 Fugitive emissions are among the most underreported yet material climate risks in building operations today.

Gas refrigerant and liquid refrigerant are integral to the cooling process, transforming between states to facilitate heat exchange.

For compliance-minded organizations, refrigerants already fall under existing mandates: In the U.S., systems over 50 pounds must be monitored, maintained, and leak-checked under EPA Section 608. But sustainability reporting demands a broader scope. Sustainability disclosures require tracking all refrigerant emissions, regardless of system size, because the climate impact isn’t constrained to regulatory thresholds. It’s measured in tons of CO₂e released into the atmosphere.

The cooling process involves key components like the expansion valve, which regulates refrigerant flow, and the system’s ability to transfer heat is vital for maintaining efficiency.

This creates a fundamental disconnect: what is legally required and what is environmentally material are no longer aligned.

Double materiality is the framework that forces alignment and brings operational emissions into the spotlight. Inefficient cooling and refrigerant leaks can significantly impact system performance and environmental footprint.

Additionally, air conditioners and AC units require refrigerant to cool warm air, ensuring a comfortable indoor environment.

The 2019 EPA Shift: The Venting Acknowledgment That Changed the Narrative

In 2019, the U.S. Environmental Protection Agency (EPA) published a rule titled “Protection of Stratospheric Ozone: Allowance System for Controlling HCFC Production and Import, 2020–2029.”

In it, the agency made a critical acknowledgment: “…given the agency’s assumption that all refrigerant produced is eventually emitted into the atmosphere…”

This was the first public confirmation that venting is the default outcome, not the exception. Despite decades of policy, leak rate limits, technician certification, and recovery equipment mandates, the underlying truth remains: most refrigerants eventually leak or are vented, contributing significantly to global warming.

This venting also exacerbates ozone depletion, particularly with refrigerants like R-22.

For decades, companies operated under the assumption that these emissions were avoidable or immaterial.

They are not.

That fundamental truth is now being built into global disclosure regimes.

The impact of refrigerant venting extends beyond global warming, as it also involves the release of greenhouse gases, which are categorized into direct and indirect emissions, further influencing corporate sustainability practices and regulatory discussions.

🧊 Make Refrigerants Count. Before They’re Counted Against You.

ESG Filings: Where Compliance and Sustainability Must Meet

Today, shareholders and investors demand the truth, and regulators require it.

Companies can no longer hide refrigerant data in technician logs or year-end maintenance summaries. Suppose you disclose that climate change affects your operations (e.g., extreme heat increases energy costs).

In that case, you must also disclose how your operations affect the climate (e.g., refrigerant leaks increasing GHG emissions).

The HVAC industry is undergoing significant changes, particularly with the transition to new refrigerants like R-410A, which impacts both comfort and environmental health.

This dual perspective is the essence of double materiality.

It’s also why refrigerants are such a compelling case study: they intersect with compliance and sustainability, operations and disclosure. In the U.S., you must track leaks and service events for compliance.

Globally, you must quantify and disclose emissions for sustainability. While compliance tracking is mandatory, many companies also voluntarily report refrigerant emissions to meet investor expectations and sustainability goals.

Comprehensive HVAC services are essential in this context, as they address a range of heating, cooling, and indoor air quality needs, emphasizing customer care and financial accessibility.

But these two systems—compliance and ESG—rarely interact. The result is fragmented reporting, lost data, and regulatory blind spots.

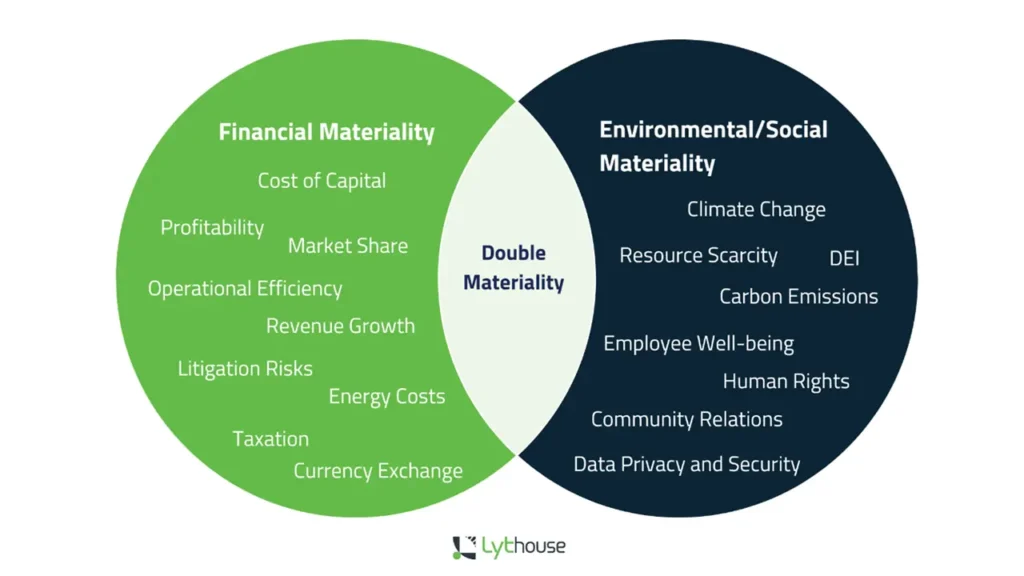

Financial and Impact Materiality: The Dual Lenses of Disclosure

Double materiality requires that companies apply two distinct, but interconnected perspectives:

Financial Materiality (outside-in):

This asks, “How do sustainability risks impact the company’s economic value?” For refrigerants, this includes:

- Leak-driven energy waste

- Increased repair costs

- Compliance fines

- Stranded assets due to phasedown of HFCs

- Capital risk from failing HVAC systems

- Insurance impacts from climate-related service disruptions

Accurate measurement of refrigerant leaks and emissions is crucial for both financial and impact materiality assessments. These risks can affect margins, cash flow, asset valuation, and investment ratings. Additionally, Scope 2 emissions can be calculated based on the details provided in energy bills.

Impact Materiality (inside-out)

This asks, “How does the company’s activity impact society and the environment?” For refrigerants, this includes:

- Greenhouse gas emissions (measured in CO₂e)

- Depletion of ozone layer protection (for legacy systems)

- Contribution to urban heat zones

- Lifecycle environmental costs associated with manufacturing, leaks, and end-of-life disposal

It is also important to track and manage emissions from natural gas usage in various industrial applications, as it is a significant source of Scope 1 emissions.

🚨 Double materiality means you can’t isolate these dimensions. You must apply both.

The EU’s CSRD and ESRS standards require it. California’s SB 219 is structured to demand it. And the Task Force on Climate-related Financial Disclosures (TCFD) embeds this thinking in its risk models.

The European Union Sustainable Finance Disclosure Regulation (SFDR) mandates that investors must disclose not only risks to themselves but also the negative impacts they may have on both the planet and society, emphasizing the principle of double materiality.

Operational Examples: Applying Double Materiality to Refrigerants

Let’s take two practical examples that show how refrigerants rise to the level of double materiality:

Example 1: Asset Obsolescence and Climate Liability

A portfolio contains two large R-123 chillers installed in 2017. By 2030, the refrigerant will be entirely obsolete and phased out. The company must now:

- Retire these assets early

- Calculate the embedded climate liability from the refrigerant charge

- Plan the financial and environmental costs of decommissioning

- Calculate the waste generated from the decommissioning and disposal of obsolete refrigerants

- Decide whether to reclaim, destroy, or store the gas, each with different emissions and risk implications

This is capital planning with climate risk fully embedded.

Example 2: Retrofit and Compliance Risk

A grocery chain operates thousands of distributed systems using R-404A. To meet emissions targets, the company retrofits to R-448A. The transition involves:

- Cost of new refrigerant and labor

- Reporting a reduction in installed GWP inventory

- Projecting energy performance post-retrofit

- Calculating changes in Scope 1 emissions for reporting to investors and regulators

- Assess the indirect emissions associated with the production and transportation of the new refrigerant

Here, impact materiality (reducing emissions) meets financial materiality (cost, ROI, regulatory risk).

Replacing Brand Mentions With Strategy: Building the Governance Backbone

📌 Data alone isn’t enough.

Companies need a governance framework that makes refrigerant emissions visible, auditable, and actionable—aligning operations, sustainability, finance, and compliance to manage long-term climate risk.

That means building a material balance sheet—a cross-departmental record of refrigerant inventories, leak rates, equipment status, and transition plans. It means aligning policy, roles, procedures, and controls across operations, sustainability, finance, and compliance.

Strategic planning is essential to aligning policy, roles, procedures, and controls across operations, sustainability, finance, and compliance. And it means making refrigerant emissions visible, auditable, and actionable.

This is the true backbone of double materiality—not just data or disclosure, but an operational culture that understands how short-term activities create long-term climate risk and manages both.

Companies embracing this approach are more resilient, transparent, and aligned with regulators’, insurers’, and capital markets’ expectations.

Double Materiality: Why Accountability Has a Science Now?

There was a time when environmental disclosure was voluntary. A time when climate accountability was a question of brand alignment or risk tolerance. That time is over.

📌 In 2025, accountability will be a science. And its name is Double Materiality.

For companies dealing with refrigerants, emissions, and energy-intensive operations, this isn’t merely a change in terminology; it’s a complete overhaul of what is considered reportable, material, and financially significant.

The previous method—tracking compliance in maintenance logs, concealing emissions in scopes, and counting systems rather than impact—is no longer acceptable.

Double materiality transforms ESG disclosures into a reciprocal process. It unveils the entire relationship between your operations and climate change, requiring answers on both fronts:

- How does climate risk affect your business model?

- And how does your business model affect the climate?

From refrigerant leaks to the obsolescence of cooling systems, your Scope 1 emissions are no longer just a line item.

They serve as a diagnostic signal—a visible thread in the emerging science of accountability. And the world is closely observing.

The CSRD Framework – Turning Double Materiality into Regulatory Reality

📜 The Corporate Sustainability Reporting Directive (CSRD) is no longer pending legislation. It is the law.

But in 2025, timelines have shifted.

Reporting expectations are real, but the deadlines for many companies have been pushed back, giving some breathing room—but not a free pass.

As of January 1, 2024, companies in the EU—and those doing business there—began transitioning beyond voluntary ESG reporting. What used to be ambition is now obligation. And what used to be marketing is now a matter of material compliance.

At the center of CSRD lies the operationalization of the Double Materiality concept. That means companies must report not only how environmental and social issues affect their business (financial materiality), but also how their business affects the environment and society (impact materiality).

CSRD represents the formalization of accountability, requiring standardized reporting across sectors, geographies, and emissions scopes, including the refrigerant emissions that reside in Scope 1.

Let’s unpack what’s required, who it applies to, and what it means for emissions-intensive operations like data centers, grocery retail, cold storage, and HVAC-driven infrastructure.

📜 Double materiality is no longer a theory: it’s a requirement.

Whether you’re in data, retail, cold storage, or HVAC, your emissions story must be clear, credible, and compliant.

What Is the CSRD?

The Corporate Sustainability Reporting Directive is the EU’s answer to fragmented, unverified, and inconsistent ESG reporting. Replacing the Non-Financial Reporting Directive (NFRD), CSRD expands both the scope of reporting and the number of entities subject to the rules.

The CSRD aligns with global frameworks such as the Global Reporting Initiative (GRI) to ensure standardized and comprehensive sustainability reporting. While Scope 1 and 2 emissions reporting is often mandatory, the CSRD also encourages voluntary reporting of Scope 3 emissions to meet evolving regulatory requirements and sustainability goals.

As of 2025, over 50,000 companies globally—including more than 10,000 non-EU companies—were expected to file CSRD-aligned sustainability disclosures.

However, in April 2025, the European Parliament approved a two-year delay for many companies. This was part of the broader “Omnibus I” simplification package aimed at reducing administrative burden and enhancing EU competitiveness.

Timeline Changes – What’s Delayed and What’s Not

| Company Type | Original Start Date | Revised Start Date | First Report Due |

|---|---|---|---|

| Companies already reporting for FY2024 | Jan 1, 2024 | No change | 2025 |

| Large companies meeting 2 of: 250+ employees, €40M+ turnover, €20M+ assets | Jan 1, 2025 | Jan 1, 2027 | 2028 (covering FY2027) |

| Listed SMEs, small credit institutions, captive insurers | Jan 1, 2026 | Jan 1, 2028 | 2029 (covering FY2028) |

| Non-EU companies with €150M+ EU turnover & 1 EU branch/sub | Jan 1, 2028 | Likely delayed to 2030 | TBD |

This delay does not eliminate the CSRD requirements. Instead, it provides time to:

- Build a reporting infrastructure

- Improve internal data governance

- Engage suppliers early for Scope 3 preparation

- Conduct early-stage double materiality assessments

The extended timeline allows companies to refine their reporting process and improve data governance.

The timeline relief should be viewed as an operational opportunity to embed sustainability into the blueprint of corporate performance, not as a reason to pause.

What Are You Required to Report under the Non-Financial Reporting Directive?

The CSRD requires companies to report across a broad ESG+ spectrum, defined through 12 European Sustainability Reporting Standards (ESRS):

Cross-Cutting Standards

ESRS 1 (General requirements), ESRS 2 (General disclosures)

Environmental Standards

Climate change, pollution, water and marine resources, biodiversity, resource use, circular economy

Social Standards

Workforce, value chain workers, affected communities, consumers, and end users

Governance Standards

Business conduct, anti-corruption, strategy, stakeholder engagement

The CSRD requirements align with the standards set by the Sustainability Accounting Standards Board (SASB).

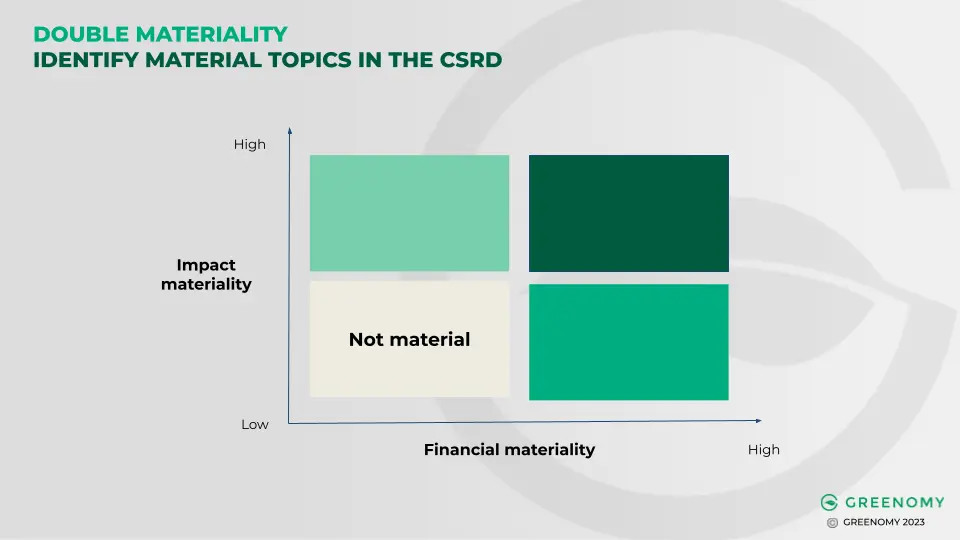

Companies must determine which of these topics are material using a double materiality lens and report accordingly.

❄️ Refrigerants Are the Climate Risk Hiding in Plain Sight

What’s Material? That Depends on Refrigerants, Too

Under CSRD, refrigerants fall squarely into the mandatory disclosure category for many asset-intensive organizations because:

- They are direct Scope 1 GHG emissions

- They have high Global Warming Potential (GWP), often >2,000× that of CO₂

- They are regulated in many jurisdictions and are phasing out rapidly

- They represent both operational and transition risk

- They impact climate, energy use, and financial performance

The environmental impact of refrigerants is significant due to their high Global Warming Potential (GWP). These substances absorb heat, which is a notable feature, but their ability to absorb heat also contributes to greenhouse gas emissions, making their environmental impact considerable.

This makes them a litmus test for whether your company is prepared to navigate the next era of climate accountability.

For grocery stores, cold chain logistics, and data centers, refrigerants are not abstract—they are core to performance. Their management determines energy intensity, system uptime, risk exposure, and ESG profile. Effective refrigerant management also involves understanding the role of the outdoor unit and outdoor air in the cooling process, as these elements are crucial for the refrigeration cycle and overall system efficiency.

If your company isn’t counting them in financial and impact terms, it will likely fail the double materiality test.

Refrigerants in Scope: Where They Appear in European Sustainability Reporting Standards

Refrigerants intersect several ESRS categories:

- E1: Climate Change – Direct emissions (Scope 1), emissions reduction targets, transition plans

- E2: Pollution – Process emissions from refrigerant leaks and disposal

- E5: Resource Use and Circular Economy – Material use, system efficiency, end-of-life handling

- G1: Governance – Risk oversight, policy enforcement, internal controls, compliance structures

The HVAC industry is undergoing significant changes, particularly with the transition to new refrigerants like R-410A and R-454B. HVAC manufacturers, such as Trane, are adapting their products and inventory strategies to meet environmental concerns and regulatory changes affecting refrigerant use.

This means your refrigerant emissions, tracking methods, and management strategies are not just operational data—they are material disclosures that must be auditable, documented, and standardized.

Companies must move away from one-off reporting and into ongoing emissions governance.

CSRD Requires Process, Not Just Policy

The days of voluntary sustainability statements are over. Under CSRD, companies must:

- Perform a double materiality assessment to determine which topics apply

- Align with ESRS and demonstrate how they reached their materiality conclusions

- Include these disclosures in the management report, subject to third-party assurance

- Digitize reports in machine-readable format using the European Single Electronic Format (ESEF)

While Scope 1 and 2 reporting is often mandatory, Scope 3 reporting is primarily encouraged through voluntary reporting frameworks and investor expectations. A robust reporting process is essential to ensure compliance with CSRD requirements.

And importantly, companies will need governance infrastructure to ensure they can maintain audit-ready records.

How This Impacts Non-EU Companies

You don’t need to be based in the EU to be subject to CSRD. If your global organization:

- Exceeds €150 million in EU turnover annually

- Operates even one branch or subsidiary in the EU

… you must comply (delays pending) by the revised deadline—potentially 2030. This will likely include many U.S. retailers, tech companies, logistics providers, manufacturers, and food suppliers.

Non-EU companies must also consider upstream emissions in their sustainability reporting to comply with CSRD. While Scope 1 and 2 reporting is often mandatory, Scope 3 reporting is primarily encouraged through voluntary reporting frameworks and investor expectations.

Which means refrigerants—long treated as a technical compliance issue—are about to become an investor-level disclosure item.

Final Thought: CSRD Brings Double Materiality to Life

While Double Materiality is the philosophy, CSRD is the execution model.

Identifying material risk is crucial for companies to navigate the CSRD mandate effectively.

If your company has:

- Cooling infrastructure

- Large fleets of refrigerant-containing systems

- Facilities in multiple jurisdictions

- Energy efficiency goals

- Transition risk tied to refrigerant phaseouts

… then you are already living inside the CSRD mandate, whether you’ve realized it yet or not.

Additionally, while Scope 1 and 2 emissions reporting is often mandatory, Scope 3 emissions reporting is primarily encouraged through voluntary reporting frameworks and investor expectations. Comprehensive environmental disclosure is becoming increasingly important as part of evolving regulatory requirements and sustainability goals.

And while regulatory enforcement may have been pushed back, market expectations have not. Early adopters will shape the benchmarks—and possibly the capital flows—of the future.

In the next section, we’ll explore how the Omnibus Package changed (and didn’t change) these obligations—and what companies need to do next.

🧭 CSRD Isn’t Coming. It’s Here.

Post-Omnibus Changes – What’s Changed and What Hasn’t

The 2025 “Omnibus I” package, finalized in early April, introduces a measured recalibration to the EU’s sustainability agenda—but it does not reverse the tide.

The headlines may read like a retreat, but the underlying structure of mandatory sustainability reporting remains intact, especially around the concept of Double Materiality. The realignment speaks to timing, not content.

The CSRD emphasizes the need for companies to consider their impact on both the planet and society.

While Scope 1 and 2 reporting is often legally required, Scope 3 reporting is primarily encouraged through sustainability frameworks and investor expectations, highlighting the trend towards both mandatory and voluntary reporting.

The Legislative Update

On April 3, 2025, the European Parliament voted overwhelmingly in favor (531 votes to 69, with 17 abstentions) to delay the second and third waves of the Corporate Sustainability Reporting Directive (CSRD) and postpone the implementation of the Corporate Sustainability Due Diligence Directive (CSDDD).

These delays were part of a broader simplification agenda proposed by the European Commission under the “Omnibus I” legislative package.

Key changes

CSRD Delay

- Companies in the first wave (already subject to the Non-Financial Reporting Directive, or NFRD) will continue reporting on FY 2024, which is due in 2025.

- Second- and third-wave companies now report starting in 2028, covering FY 2027.

CSDDD Delay

- The first group of in-scope companies will begin reporting due diligence findings in June 2028 for the 2028 fiscal year.

These changes affect implementation, not obligation. Double Materiality remains the cornerstone of CSRD and the underlying European Sustainability Reporting Standards (ESRS).

What Hasn’t Changed: The Imperative of Double Materialism

The delay does not alter the requirement to perform and disclose a Double Materiality assessment. Nor does it change the alignment of the CSRD with the Task Force on Climate-related Financial Disclosures (TCFD), nor its interoperability with global frameworks like GRI and ISSB.

The core philosophy—understanding a company’s impact on the world, as well as how sustainability issues affect the company—remains unchallenged.

📌 The lesson?

Companies have more time, but not less responsibility.

This is a strategic window to build systems, validate data, and embed environmental governance into operational workflows.

SB 219 – California’s Parallel Path

Let’s take two practical examples that show how refrigerants rise to the level of double materiality:

Identifying and managing emissions sources is critical for effective climate risk management.

Asset obsolescence is a significant concern, especially with older HVAC systems.

Replacing outdated units with newer, more efficient heat pump systems can mitigate this risk.

A heat pump offers an environmentally friendly alternative to traditional air conditioning, aligning with sustainability goals.

Retrofit and compliance risk are also crucial factors. As HVAC manufacturers transition to new refrigerants like R-454B, they adapt their products to meet regulatory changes. Heat pumps play a vital role in this transition, offering modern solutions that comply with updated environmental standards.

Refrigerant management is essential for maintaining system efficiency and environmental compliance. Understanding the role of HVAC refrigerants in the refrigeration cycle helps in making informed decisions about system upgrades and maintenance.

Refrigerant leaks can significantly impact system performance, leading to inefficient cooling. Timely repairs are necessary to ensure the effective operation of the AC unit and to prevent further environmental harm.

The mechanics of refrigerants, such as the pressure drop associated with R-32, highlight its efficiency in heat transfer. This refrigerant has a proven track record in markets like China, Japan, and India, demonstrating its reliability and effectiveness.

Enforcement & Assurance

SB 219 introduces limited assurance for Scope 1 & 2 data by 2026, with a ramp-up to reasonable assurance by 2030.

While Scope 3 emissions reporting has more leniency, the inclusion of upstream and downstream emissions into disclosure rules marks a profound operational shift.

Global Signal from the International Sustainability Standards Board

California is the fourth-largest economy in the world. Its regulatory actions don’t just set standards—they redefine markets. SB 219 has become the de facto benchmark for U.S. companies, many of which must now align with both European and Californian disclosure regimes.

The result? Double Materiality assessments are now a reality on both coasts.

TCFD – The Bridge Between Risk and Disclosure

Before CSRD and SB 219 took center stage, the Task Force on Climate-related Financial Disclosures (TCFD) quietly laid the groundwork for today’s climate reporting landscape.

Launched in 2015 by the Financial Stability Board, the TCFD offers a structured framework to help companies disclose climate-related financial risks and opportunities.

The TCFD framework is aligned with the standards set by the International Sustainability Standards Board (ISSB). It rests on four core pillars:

- Governance – Who oversees climate risk?

- Strategy – What’s the business plan for a warming world?

- Risk Management – How are threats identified and mitigated?

- Metrics and Targets – What gets measured, and how?

❄️ Don’t Let Refrigerants Become a Hidden Liability

Why It Matters for Refrigerants

Refrigerants fall into both physical and transition risk categories:

Physical Risks

Leaks during heat waves or power outages can destroy inventory (e.g., grocers), cause service disruptions (e.g., data centers), and damage reputations.

Transition Risks

Regulatory crackdowns on HFCs, carbon pricing, and supply shortages of legacy refrigerants expose companies to asset write-downs and costly retrofits.

From Reporting to Resilience

By embedding refrigerant management into the TCFD model, companies can better:

- Quantify exposure from aging assets

- Model risks of delayed transitions to low-GWP refrigerants

- Prepare financial markets for capital expenditures tied to sustainability mandates

TCFD transforms disclosure into a tool for risk profiling and strategic alignment, making it an essential building block of Double Materiality assessments.

Sector Spotlight – Refrigerants in Grocery, Cold Chain, and Data Centers

Some sectors carry a disproportionate share of refrigerant-related risk and responsibility. These stand out:

- Grocery retail

- Cold chain logistics

- Data centers

- Logistics companies must also consider emissions from company-owned vehicles as part of their overall refrigerant management strategy.

These industries operate high-GWP refrigerants across large, distributed footprints and rely on uninterrupted cooling for business continuity.

The Problem

- Grocery chains like Walmart and Dollar Tree have publicly disclosed losses in the millions due to refrigerant leaks, operational failures, and fines.

- Cold chain logistics companies face spoilage risks from minor refrigerant disruptions.

- Data centers run around-the-clock cooling, making any HVAC failure a potential catastrophe.

Leaks don’t just vent GHGs—they hemorrhage value.

The Solution

In each sector, Double Materiality forces companies to:

- Assess the financial cost of refrigerant management

- Map emissions at the asset level

- Integrate leak data into ESG reporting

Some leading grocers have already begun to tag all refrigeration assets, track charge levels, and map maintenance records to regulatory and sustainability metrics.

The Advantage

Companies that operationalize refrigerant tracking gain:

- Early warning systems for asset failure

- Compliance with CSRD, SB 219, and CARB, including both mandatory and voluntary reporting of Scope 1, 2, and 3 emissions

- Investor-grade insights into their climate profile

This isn’t just a sustainability initiative. It’s a supply chain initiative, a facilities initiative, and a risk management initiative—all converging under the Double Materiality lens.

Walmart and the Role of Stewardship

The final lens is behavioral. Who sets the tone for climate leadership in the U.S.? Increasingly, it’s not just governments—it’s corporations with global footprints.

Walmart, the world’s largest retailer, operates under both U.S. and European regulatory regimes.

With stores, data centers, and warehouses across both continents, Walmart has become a bellwether for cross-jurisdictional ESG adaptation. Walmart’s commitment to sustainable development sets a benchmark for other companies in the industry.

Why This Matters

As Walmart adapts to CSRD requirements abroad, it will inevitably apply the same rigor to U.S. operations. That ripple effect will:

- Pressure suppliers and peers to raise their disclosure standards

- Normalize TCFD, Scope 3, and refrigerant reporting

- Drive voluntary best practices that preempt regulation

- Encourage both mandatory and voluntary reporting of Scope 1, 2, and 3 emissions

Stewardship by Influence

This is the new governance layer: Market-driven compliance. When leaders like Walmart align ESG strategy across jurisdictions, they become non-governmental policy accelerators.

Double Materiality isn’t just being enforced—it’s being modeled. And the companies paying attention will be the ones most prepared when compliance becomes not just a mandate, but an expectation.

Operationalizing the Mandate

The shift from voluntary sustainability efforts to mandatory disclosure obligations—driven by CSRD, SB 219, and the influence of market stewards like Walmart—demands more than awareness. It requires action.

A streamlined reporting process is essential for meeting the new disclosure obligations.

Action rooted in data governance. Action rooted in policy alignment. Action rooted in operational accountability.

This final section details how to translate the principles of double materiality into repeatable processes, auditable data, and decision-ready insight.

The Problem: Fragmented Data, Siloed Teams, and Undefined Ownership

Companies struggling with refrigerant and sustainability reporting often face a common scenario:

- Operations has the data—but no mandate to translate it.

- Compliance knows the regulations, but lacks visibility into asset-level decisions.

- Finance understands risk, but sees emissions as a black box.

Effective data governance must also account for emissions from raw materials used in operations.

Without a clear framework for materiality assessment and cross-functional alignment, organizations default to ad hoc data pulls, incomplete disclosures, and reactive ESG strategies.

And as CSRD and SB 219 bring new requirements for assurance, value chain reporting, and emissions tagging, these gaps become liabilities.

🛠️ The Solution Starts with Systems

The Solution: Build a Policy-Driven Data Infrastructure

Operationalizing the mandate begins with integrating double materiality into the heart of your organization’s governance and systems. This means:

Policy Alignment

Establish clear internal policies that define how Scope 1 refrigerant emissions, leak detection protocols, and asset maintenance plans are recorded, reconciled, and reported.

Material Balance Sheets

Use your asset inventory as the foundation for your environmental reporting. Every site, every piece of equipment, every refrigerant transaction—quantified and tagged.

Pre-Audit Readiness

Prepare for limited assurance (and eventually, reasonable assurance) by ensuring all emissions data is traceable, timestamped, and mapped to a compliance standard.

Supplier and Upstream Integration

Begin building data-sharing expectations into vendor contracts—especially for equipment suppliers, refrigerant wholesalers, and service providers.

Purchased Electricity

Include data on purchased electricity to account for Scope 2 emissions.

Companies need to institutionalize the concept that accountability is a science. That science begins with systems.

What to Implement: The Core Blueprint

Data Governance Framework

- Audit pathways: Implement version control and documentation protocols.

- Define roles:

- Sustainability officer,

- Refrigerant program lead,

- ESG data custodian.

- Centralized repositories: Use cloud-based systems to unify refrigerant service logs, emissions calculations, and compliance timelines.

Double Materiality Workflow

- Financial lens: Tag systems and events that could impact costs, insurance claims, or shareholder exposure.

- Impact lens: Measure refrigerant leaks, venting events, and environmental severity (e.g., GWP, volume).

- Impact lens: Measure emissions from chemical reactions in manufacturing processes.

- Intersection: Identify where financial and environmental dimensions meet—those are your priority disclosures.

Asset Tagging and Registry Integration

- Label all high-GWP assets with scannable tags.

- Include refrigerant type, charge amount, installation date, and leak history.

- Integrate these tags into your refrigerant tracking system and ESG disclosures.

Performance Monitoring & Leak Detection

- Use historical leak data to profile risk and drive retrofit investment.

- Deploy real-time sensors or digital logs to catch leaks early.

- Feed alerts into ESG dashboards.

Scenario Planning and Disclosure Alignment

- Disclose adaptation strategies and mitigation plans.

- Use the TCFD framework to anticipate climate-related risks (e.g., grid stress from HVAC loads).

- Map these risks to refrigerant use and maintenance patterns.

🧩 From Blueprint to Execution: Build the Backbone of ESG Reporting

The Advantage: Resiliency, Readiness, and Investor-Grade Insight

Companies that take these steps today will:

- Be prepared for future regulatory tightening (CSRD, SEC, SB 219)

- Gain competitive positioning with sustainability-minded investors

- Reduce long-term risk through early leak detection and proactive infrastructure management

- Reduce overall carbon footprint through early leak detection and proactive infrastructure management

- Build trust through data transparency and audit-ready records

The era of general statements and soft commitments is ending. In its place is a new operational blueprint where refrigerants, data quality, and cross-border compliance are strategic priorities—not afterthoughts. The CSRD requirements also highlight the trend towards both mandatory and voluntary reporting of Scope 1, 2, and 3 emissions, emphasizing the importance of comprehensive environmental disclosure.

Accountability has a science. And that science begins when your ESG story is built on policy, infrastructure, and fact.

Conclusion: Where We Go From Here

This is no longer about tracking emissions in isolation or checking boxes to satisfy auditors. What we are witnessing is a structural shift in how climate accountability is understood, documented, and enforced. It’s not just a new reporting mandate—it’s a new way of thinking about risk, responsibility, and return on effort.

Understanding the environmental impact of refrigerants is crucial for effective climate accountability.

Double materiality has emerged as the connective tissue linking regulatory compliance, climate risk, and business strategy. It demands that companies measure not just how the world impacts them, but how they impact the world.

For refrigerant-intensive industries—grocers, cold chain operators, data centers—this reframing is more than academic. It touches systems, budgets, and boardroom strategy.

When you take the full scope of this story—from the financial and impact logic behind double materiality to the regulatory mechanics of CSRD and SB 219, to the strategic pressure from leading market actors like Walmart—one truth becomes clear: sustainability is no longer about storytelling. It’s about record-keeping, risk modeling, and operational readiness.

The CSRD requirements also highlight the trend towards both mandatory and voluntary reporting of Scope 1, 2, and 3 emissions, emphasizing the importance of comprehensive environmental disclosure.

Companies that recognize this shift and act accordingly won’t just meet disclosure deadlines. They’ll be ahead of them.

And in the process, they will position themselves not only as compliant operators but as credible, long-term stewards of environmental and financial health.

To build a sustainable business is to build a decision-ready one. One where operational data, emissions accountability, and future planning converge. And that future begins now.