CARB’s Preliminary SB 253 / SB 261 Disclosure List: Phase 1 Insights, Phase 2 Implications, and International Expansion

How California’s Scope 1 Disclosure Rules Will Redefine Global Non-Financial Reporting, and the Tools Behind It.

Table of Contents

ToggleIntroduction to the California Air Resources Board

The California Air Resources Board (CARB) stands at the forefront of environmental regulation in the United States, with a mandate to safeguard public health, welfare, and California’s diverse ecosystems through the reduction of air pollutants, as governed by the California Air Resources Board.

As the principal agency overseeing air quality and emissions standards, CARB plays a pivotal role in shaping the regulatory landscape for businesses operating within the state.

For companies considering international business expansion or already conducting business in California, understanding CARB’s authority is critically important, especially as it relates to climate-related financial risk and compliance with landmark legislation such as SB 253 and SB 261.

To help identify companies potentially subject to SB 253 and SB 261, CARB publishes a preliminary list, known as CARB’s list.

The carb’s list is a tentative register used for regulatory and compliance purposes, helping companies determine whether they might be affected by California’s climate-related disclosure requirements.

It serves as an initial, non-final indicator for entities that may need to comply with upcoming climate disclosure regulations.

The CARB list is created by CARB using publicly available business data and revenue thresholds to identify companies that may fall under the scope of SB 253 and SB 261; its purpose is to provide early notice to potentially regulated entities, allowing them to assess their compliance obligations and prepare for disclosure requirements.

However, CARB’s preliminary list is based on records from the California Secretary of State’s database as of March 2022 and may contain inaccuracies or outdated information.

Companies appearing on or near the carb’s list should carefully review their status, as inclusion signals a need to evaluate compliance steps and readiness for California’s climate disclosure laws.

→ Discover our HVAC/R Knowledge Hub

Companies preparing for climate-related financial risk disclosures

CARB’s responsibilities extend beyond traditional air quality management to include the enforcement of climate-related financial risk disclosure requirements, which are crucial for regulatory compliance.

Under SB 253 (Climate Corporate Data Accountability Act) and SB 261 (Climate-Related Financial Risk Disclosure Act), the Air Resources Board CARB is tasked with identifying, monitoring, and ensuring that companies meet rigorous standards for greenhouse gas emissions reporting and climate risk transparency.

Approximately 2,600 companies are estimated to be subject to SB 253 according to CARB. Companies should confirm and validate their inclusion on the CARB’s list and assess their applicability under the statutes to ensure compliance with regulatory requirements.

CARB staff also provides an estimate of the number of companies that may be affected by these new disclosure laws, offering stakeholders a preliminary sense of the legislation’s scope.

This regulatory framework is not only reshaping the way businesses approach environmental compliance but is also influencing international business expansion strategies, as companies must now factor in climate-related financial obligations when entering or operating in the California market.

For any business aiming to thrive in this environment, a thorough understanding of CARB’s evolving role is essential for effective risk management and long-term success.

→ Discover our HVAC/R Knowledge Hub

Overview

On September 24, 2025, the California Air Resources Board (CARB) released its preliminary list of companies that will be subject to the Climate Corporate Data Accountability Act (SB 253) and the Climate-Related Financial Risk Disclosure Act (SB 261).

This list represents the first tangible step toward California’s climate-disclosure enforcement, identifying corporate entities with over $500 million (SB 261) or $1 billion (SB 253) in global annual revenues that are “doing business” in California. The inaugural reports under SB 261 are due January 1, 2026.

CARB typically follows a standard process in compiling and publishing the preliminary list, which includes data collection, cross-referencing, and holding public workshops.

CARB is taking steps to ensure that the programs are the least burdensome for implementation and compliance.

California advances its first major climate disclosure rollout under SB 253 and SB 261. Assess your inclusion and compliance strategy.

Data analysis used by CARB to compile the preliminary list

The file published by CARB contains 4,170 entities, categorized as follows, reflecting the ongoing development of climate disclosure compliance, marking a significant step in regulatory progress.

| Category | Count | Share |

|---|---|---|

| Entities subject to SB 261 only | 1,570 | 37 % |

| Entities subject to SB 253 + SB 261 | 2,600 | 63 % |

| Total | 4,170 | 100 % |

| The criteria and methodology for inclusion on the preliminary list were discussed during CARB’s recent public workshop, emphasizing the importance of thorough data analysis. |

State Distribution: Concentration of Registrations

Top 10 Jurisdictions

| Rank | Jurisdiction | Company Count | Share |

|---|---|---|---|

| 1 | California | 1,657 | 39.7 % |

| 2 | Delaware | 1,440 | 34.5 % |

| 3 | New York | 112 | 2.7 % |

| 4 | Maryland | 71 | 1.7 % |

| 5 | Nevada | 65 | 1.6 % |

| 6 | Pennsylvania | 58 | 1.4 % |

| 7 | Massachusetts | 51 | 1.2 % |

| 8 | Ohio | 50 | 1.2 % |

| 9 | New Jersey | 47 | 1.1 % |

| 10 | Indiana | 44 | 1.1 % |

📌 Key statistic

≈ 90 % of listed entities are incorporated in California or Delaware.

This does not reflect where companies operate, but where they are legally domiciled, underscoring that CARB’s preliminary list tracks incorporation, not economic presence.

Implication

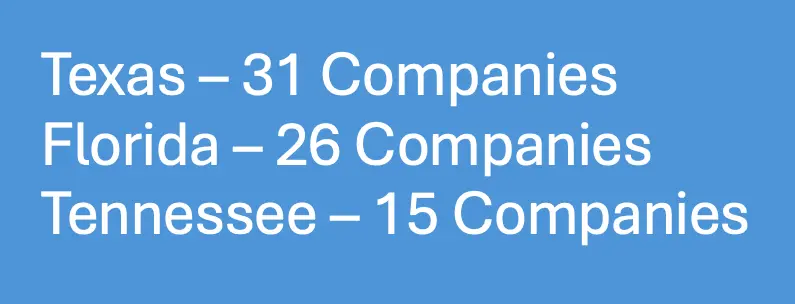

States such as Texas, Tennessee, and Florida are almost invisible despite massive operating footprints in California. This is due to CARB’s methodology, which relied on:

- California Secretary of State (SOS) business registry, and,

- Dun & Bradstreet (D&B) revenue data cross-matching.

Consequently, entities incorporated elsewhere but active in California through retail, distribution, or service operations were excluded unless they had a foreign-qualified entity on file.

In particular, ‘foreign parent filings’ refer to cases where the parent company is registered outside California, which can obscure inclusion if the local subsidiary does not have a separate California registration.

→ Discover our HVAC/R Knowledge Hub

Corporate Form Breakdown

| Entity Type | Count | Share |

|---|---|---|

| Stock Corporation – Out of State | 2,274 | 54 % |

| Stock Corporation – California | 1,389 | 33 % – increase in efficiency using the Asset Tagging App – Tag Wizard, especially when considering double materiality in your sustainability strategy. |

| Nonprofit – Out of State | 178 | 4 % |

| Nonprofit – CA Public Benefit | 158 | 4 % |

| Limited Liability Company (CA + OOS) | 105 | 2.5 % |

| Other (Association / Statutory) | 66 | 1.5 % |

Interpretation

The dataset is dominated by publicly held stock corporations and thus under-represents private, foreign-owned, and family-held enterprises, precisely the classes driving California’s retail, agriculture, and logistics emissions footprint.

Sectoral Gaps and Missing Companies

Sectors Under-represented in Phase 1

| Sector | Typical Examples Missing | Structural Reason |

|---|---|---|

| Food Retail / Cold Chain | Trader Joe’s, ALDI, Sprouts, Smart & Final, and C&S Wholesale; all these retailers can benefit from enhanced compliance with refrigerant management regulations using tools like Tag Wizard. | Foreign or privately held; out-of-state filings; no direct CA SOS record |

| Agriculture / Vineyards / Beverage – Learn more about effective leak detection methods for budget management. | E.& J. Gallo, The Wine Group, Constellation Brands | Private LLCs; registered under subsidiaries, multiple small entities |

| Data Centers / REITs | Digital Realty, CoreSite, CyrusOne; organizations that can benefit from understanding states leading the charge in refrigerant-aligned compliance. | Operate via REITs and limited partnerships (LPs) outside the CA registry |

| Manufacturing / Industrial | Siemens, BASF, Toyota, LG Electronics | Foreign HQ; CA presence via sales or plants; not matched to D&B/SOS |

| Wholesale Distribution | SpartanNash, C&S Wholesale, UNFI | Indirect economic nexus via customers; private structures |

| Hospitality / Tourism | Marriott International subs, Airbnb Ireland | Complex cross-border ownership; digital operations bypass SOS. Regulations are changing fast; looking the other way is not an option. |

📌 Summary

CARB’s dataset systematically omits entities operating in California without filing a California-domiciled business record, even when their sales, property, or payroll clearly meet Franchise Tax Board (FTB) thresholds.

Phase 2 Forecast: Total Universe Expansion

| Category | Phase 1 (2025) | Expected Additions (Phase 2 – 2026) | Est. Total |

|---|---|---|---|

| U.S. HQ Corporations | ~3,900 | + 900 | 4,800 |

| Foreign HQ Multinationals | < 50 | + 650 | 700 |

| Private / Family Owned | ~200 | + 700 | 900 |

| Total | 4,170 | + 2,200 (≈ 50 %) | 6,300 ± 200 |

Phase 2 will likely grow the reporter universe by nearly 50 %, reaching ≈ 6,500 entities once foreign and private-sector filers are reconciled through FTB nexus data and subsidiary linkages.

As Phase 2 expands the reporter universe, it has the ability to provide a more comprehensive and accurate view of the companies subject to SB 253 and SB 261.

The next steps for companies include preparing for additional reporting requirements and planning for the integration of new data sources in the next phase.

Good faith efforts toward compliance will be recognized by CARB during the initial reporting cycle.

International Expansion: Country Highlights

🇩🇪 Germany

- ALDI Süd / Nord, BASF, Siemens, BMW, Mercedes-Benz

- High CA sales, retail, and R&D footprints; all exceed nexus thresholds.

- Many German companies operate in multiple markets, increasing their exposure to CARB’s regulations.

- Likely SB 261 filers by 2026 despite being missing from the preliminary list.

🇫🇷 France

- Danone North America, L’Oréal USA, Schneider Electric, Air Liquide

- Manufacturing & logistics presence in CA; multiple public-benefit entities.

- Pre-aligned with EU CSRD → easier transition into SB 261 compliance.

- French companies often collaborate with local partners to facilitate compliance and market entry in California.

🇨🇳 China

- BYD Motors (Lancaster, CA HQ) is already on the list.

- Huawei, Alibaba Cloud, and Lenovo meet sales-nexus criteria but are absent.

- Chinese multinationals with operations in multiple countries face complex compliance challenges under CARB’s framework.

- Expect future inclusion once CARB reconciles technology subsidiaries.

🇲🇽 Mexico

- Bodega Latina / Chedraui, Grupo Bimbo, Cemex USA

- Each operates major CA distribution or retail assets.

- Out-of-state or foreign parent filings currently obscure inclusion.

- The home country of these companies, such as Mexico, influences their reporting obligations and compliance strategies in California.

FTB § 23101 “Doing Business” Tests

| Criterion | 2025 Threshold | Example Companies Meeting It |

|---|---|---|

| Sales in CA | >$690,144 gross receipts | Trader Joe’s, ALDI, Bimbo Bakeries, Danone NA |

| Property in CA | >$69,015 CA asset value | Siemens, BYD, Digital Realty |

| Payroll in CA | >$69,015 CA compensation | Food chains, tech manufacturers |

| 25 % Rule | > 25 % of total sales/property/payroll in CA | ALDI, Trader Joe’s, Chedraui subs |

| Under these thresholds, nearly all missing retail, manufacturing, and data-center operators qualify as “doing business.” |

Responsibilities Under SB 253 and SB 261

| Statute | Applies To | Core Requirement | Frequency | Enforcement Body | First Report Due |

|---|---|---|---|---|---|

| SB 253 – Climate Corporate Data Accountability Act | Entities with > $1 billion global revenue and their Scope 1 reporting responsibilities | Annual GHG emissions disclosure (Scopes 1–3), verified by a third party | Annual (FY 2026 report due 2027) | CARB – For information on HVAC leak detector solutions that help with compliance and system performance, read our comprehensive guide. | FY 2026 (verified 2027) |

| SB 261 – Climate-Related Financial Risk Disclosure Act | Entities > $500 million global revenue may need to pay particular attention to refrigerant leak detection and evolving compliance regulations. | Biennial TCFD/ISSB-style risk report describing governance, strategy, metrics, and risk management | Inspect your HVAC system for refrigerant leaks every 2 years to ensure optimal performance. | CARB | January 1, 2026 |

| CARB publishes preliminary list to help companies determine their reporting obligations under SB 253 and SB 261, which may include environmental compliance efforts such as refrigerant leak detection solutions. |

🚨 Critical nuance

Being absent from CARB’s preliminary list does not exempt an entity from these duties. Responsibility is triggered by meeting revenue + nexus criteria, not by being listed.

Policy Implications & Observations

Regulatory Bias Toward Domestic Filers

The current list favors California and Delaware registrations, leaving cross-border operators invisible to CARB’s preliminary sweep.

Data Integrity Gaps

CARB’s dependence on SOS and D&B data omits complex ownership networks and foreign parents. Phase 2 must integrate FTB tax nexus, SEC subsidiary disclosures, and international parent linkages.

These efforts will involve coordination among multiple data sources, stakeholders, and regulatory bodies to ensure comprehensive compliance. Robust data analysis will be essential in Phase 2 to ensure accurate identification of companies and regulatory compliance.

Data and compliance outcomes must be carefully evaluated to ensure that the policy design is effective and meets regulatory objectives.

Addressing these challenges requires careful consideration to ensure accurate and efficient policy design.

Sectoral Risk

Food retail, cold chain, and data infrastructure have large emissions and climate-risk footprints but low visibility. These will be the first major expansions once Phase 2 matching begins.

Improving efficiency in the process of identifying and including underrepresented sectors is necessary. Careful consideration is needed to identify and mitigate sector-specific risks effectively.

International Convergence

Entities already subject to EU CSRD or UK TCFD/ISSB will likely align filings across regimes, turning SB 261 into the U.S. mirror framework for global climate-risk reporting.

Governance and Enforcement Outlook

CARB is expected to issue final implementation guidance in Q1 2026, with penalty enforcement beginning FY 2027 for SB 253 and Q2 2026 for SB 261 non-filers. Clarifying the Nature of SB 253 and SB 261: not Environmental Regulations, but Shareholder Reporting Obligations.

It is important to understand that SB 253 and SB 261 are not environmental regulations in the traditional sense.

Companies will not be fined based on the level of their greenhouse gas emissions, whether high or low. Instead, the penalties under these laws arise from failure to report required data accurately and on time, or from providing misleading or incomplete information.

This distinction highlights that these laws are fundamentally about transparency and accountability in non-financial reporting, rather than direct emissions control or environmental enforcement.

CARB’s evolving disclosure rules redefine corporate reporting, not emissions control. Evaluate your data readiness and compliance exposure.

What is Non-Financial Data and Why Does it Matter?

Non-financial data refers to information beyond traditional financial metrics, encompassing environmental, social, and governance (ESG) factors that influence a company’s long-term performance and risk profile.

In the context of SB 253 and SB 261, this includes detailed disclosures of greenhouse gas emissions (Scopes 1, 2, and 3) and climate-related financial risks.

Such data provides shareholders and investors with critical insights into how a company manages climate-related challenges and opportunities in the global market.

The Importance of Non-Financial Reporting for Shareholders

Shareholders rely on non-financial data to evaluate the sustainability and resilience of their investments. Climate-related disclosures enable investors to assess a company’s exposure to regulatory, operational, and key risks associated with climate change.

This information supports informed decision-making about where to allocate capital, helping to identify companies that are effectively managing risks and positioning themselves for overall survival and long-term success.

By mandating rigorous, verified reporting under CARB’s framework, SB 253 and SB 261 ensure that shareholders have access to consistent, reliable, and comparable non-financial information.

This transparency fosters market integrity, reduces information asymmetry, and encourages companies to improve their environmental and financial performance.

In summary, SB 253 and SB 261 represent a shareholder-focused disclosure regime designed to enhance the quality and availability of climate-related non-financial data, not a direct emissions regulation imposing fines based on pollution levels.

Compliance is about accurate reporting and transparency, which ultimately benefits investors, companies, and the broader market.

Executive Summary: What to Expect Next

| Dimension | Phase 1 (Prelim 2025) | Phase 2 (Full 2026 Est.)Learn more about the importance of Earth Day for a sustainable future. |

|---|---|---|

| Entities listed | 4,170 | ~6,300 ± 200 |

| Foreign HQ companies | < 50 | ~650 ± 150 |

| Sector breadth | Tech + Finance | Adds Food, Data Centers, and Agriculture |

| Top jurisdictions | CA / DE = 90 % | Broader U.S. and foreign inclusion |

| First SB 261 reports due | — | Jan 1 2026 |

| First SB 253 GHG report due | — | FY 2026 → 2027 |

| Enforcement risk | Low (identification) | High (non-reporting penalties up to $500 k per year)** |

Motivation Behind SB 253 and SB 261 Disclosures: Protecting Shareholders and Ensuring Market Integrity

The primary motivation for California’s SB 253 and SB 261 disclosure requirements is to protect shareholders by providing transparent, reliable information about climate-related financial risks.

As climate change increasingly impacts business operations and financial performance, investors demand clear insights into how companies manage these risks.

These laws ensure that companies disclose comprehensive data on greenhouse gas emissions and related financial exposures, enabling shareholders to make informed decisions and hold corporations accountable.

Beyond shareholder protection, these disclosure mandates also serve to uphold market integrity by preventing misleading marketing signals and greenwashing. Companies may be tempted to present overly optimistic or unsubstantiated claims about their environmental performance to attract investors or customers.

By requiring standardized, verified reporting under CARB’s framework, SB 253 and SB 261 help ensure that all climate-related communications are grounded in accurate data. This reduces the risk of misinformation in the marketplace, fostering trust among investors, regulators, and the public.

Together, these motivations underscore the dual role of California’s climate disclosure laws: enhancing financial transparency for investors and promoting truthful environmental accountability in corporate communications.

Understanding this purpose is crucial for businesses preparing to comply with these evolving regulatory demands and for stakeholders interpreting the resulting disclosures.

SB 253 and SB 261 establish verified climate reporting to prevent greenwashing and reinforce investor trust. Align your disclosures with CARB standards.

Conclusion

CARB’s preliminary roster represents an administrative starting point, not a compliance ceiling. As Phase 2 integrates economic nexus, foreign subsidiaries, and private filers, the scope will expand by ~50 %, encompassing:

- Every multinational with California sales above $700k,

- Every retailer or manufacturer employing Californians or owning assets in the state, and

- Foreign parents (Germany, France, China, Mexico, UK, Switzerland) whose U.S. entities exceed the statutory revenue thresholds.

In practical terms, SB 253 and SB 261 together establish the most comprehensive climate-disclosure regime in the world, and will have impacts across North America, linking financial risk and Non-Financial Data to state-level enforcement.

CARB’s framework will play a crucial role in shaping global climate disclosure standards, setting a benchmark for transparency and accountability. Companies should explore their compliance strategies now to stay ahead as the scope expands.

Phase 2 will be the inflection point: moving from a legal-registration list to an operational-reality map of California’s global economic network.

6,000 Reporters, 12 % of Global Enterprises, Over 60 % of Global Corporate Emissions

How California’s Disclosure Rules Are Becoming the World’s Primary Carbon Data Engine

California’s twin climate disclosure laws (SB 253 (Climate Corporate Data Accountability Act) and SB 261 (Climate-Related Financial Risk Disclosure Act)) were conceived as state statutes. Yet their practical reach now extends far beyond U.S. borders.

Once CARB’s Phase 2 roster expands to roughly 6,000 covered entities, it will capture about 12 percent of the world’s large-enterprise population; the multinationals that collectively produce more than 60 percent of all reported corporate greenhouse-gas emissions.

This imbalance between headcount and impact is structural: a few thousand global conglomerates control the supply chains, logistics networks, and energy use that define industrial carbon intensity.

By requiring these firms to measure and verify Scope 1 operational emissions and to disclose financial exposure to climate risk, California is, in effect, creating the first operational bridge between industrial process data and the global financial system.

The result is not simply transparency within one jurisdiction; it is a de facto global accounting architecture for non-financial data.

The benefits of California’s disclosure regime include increased transparency, greater accountability, and enhanced value for stakeholders, as these outcomes are achieved through rigorous assessment and reporting standards. Three dynamics explain why this matters:

Market Gravity

California’s economy (~$4.7 trillion GDP) rivals a G-7 nation. Any company doing meaningful business there must adopt the state’s data and verification standards to retain market access.

Once implemented, those same datasets will satisfy the EU’s CSRD, the ISSB’s IFRS S2, and emerging UK and Canadian regimes.

Systems Convergence

To comply, firms must deploy interoperable carbon-accounting, asset-tagging, and verification platforms; tools that connect building sensors, energy meters, and enterprise ledgers.

These systems transform carbon disclosure from an ESG exercise into auditable operational intelligence, fusing engineering data with finance.

Regulatory Contagion

Because California’s verification process feeds into SEC-level assurance frameworks and global investor demands, it effectively establishes the template for Scope 1 data governance worldwide.

Other jurisdictions will mirror its assurance thresholds rather than reinvent them, accelerating convergence around a common digital taxonomy for emissions reporting.

In short, California’s regime is no longer a regional rule; it is the global intake valve for verified carbon data. California is now the central place where global carbon disclosure and data verification converge, setting the standard for other jurisdictions.

The six thousand companies that file in 2026 will form the nucleus of a worldwide system where non-financial performance is measured with the same rigor, assurance, and investor consequence as financial reporting.

For regulators, it is an enforcement framework; for corporations, it is a data-infrastructure mandate; and for capital markets, it is the long-awaited mechanism that makes climate risk quantifiable and tradeable.

Customer Base and Market Trends

For businesses eyeing international business expansion into foreign markets like California, a deep understanding of the customer base and prevailing market trends is a foundational step for successful business in California.

Comprehensive market research enables companies to identify the unique characteristics of their target market, including demographic shifts, consumer preferences, and evolving expectations around sustainability, which is crucial for development.

In California, where environmental consciousness is particularly pronounced, there is a growing demand for grocery products and services that align with sustainable and eco-friendly values.

The growing demand for sustainable grocery retail in California is evident in industry events focused on environmental topics and HVAC/R best practices.

This trend is further reinforced by the state’s robust regulatory environment, where climate-related financial risk disclosure is becoming a standard expectation for companies of all sizes.

Businesses must not only tailor their offerings to meet the needs of California’s diverse and environmentally aware customer base but also ensure that their international expansion strategy incorporates compliance with local regulations, such as those enforced by California Refrigerant Management and CARB.

By proactively addressing these factors, including CARB’s preliminary SB 253 and SB 261 disclosure list phase 1 insights, companies can position themselves as responsible market leaders, build trust with consumers, and mitigate potential risks associated with non-compliance.

Ultimately, aligning business operations with both market trends and regulatory requirements is key to unlocking growth opportunities and establishing a strong foothold in California’s dynamic economy.

Sustainability now defines California’s grocery market and compliance landscape. Integrate CARB disclosure readiness into your growth strategy.

Local Competitors and Market Analysis

Entering a new market like California requires more than just understanding customer preferences; it demands a strategic approach to analyzing local competitors and the broader competitive landscape.

Conducting a thorough market analysis allows businesses to identify key players, assess their market share, and evaluate the strategies that have contributed to their success.

This insight is invaluable for companies seeking to differentiate themselves and capture a meaningful share of the global market.

Regulatory compliance is another critical component of a successful international expansion strategy. California’s climate-related financial risk disclosure laws, including SB 253 and SB 261, set a high bar for transparency and accountability.

CARB’s preliminary list of companies subject to these regulations serves as an essential reference point for businesses to determine their obligations and ensure they are prepared to meet all reporting requirements.

By carefully evaluating the competitive environment and integrating regulatory compliance into their international expansion plans, while also considering key risks, companies can successfully launch their operations in California, navigate the complexities of climate change regulation, and achieve sustainable growth in new markets.

This proactive approach not only supports long-term business objectives but also enhances reputation and resilience in an increasingly interconnected global economy.

📌 This proactive approach not only supports long-term business objectives but also enhances reputation and resilience in an increasingly interconnected global economy.

The Scope 3 Cascade: Why the Other 45,000 Companies Won’t Stay Outside the System

The Mechanics of Scope 3 Inclusion

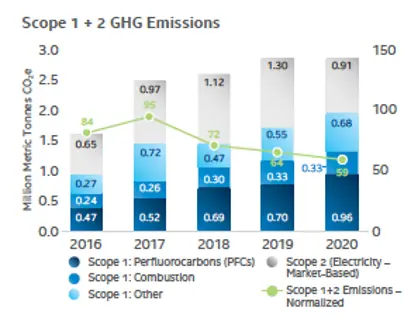

Under SB 253, covered entities must disclose:

- Scope 1: Direct operational emissions (combustion, onsite energy use).

- Scope 2: Indirect emissions from purchased energy.

- Scope 3: All other upstream and downstream emissions: purchased goods, logistics, waste, use of sold products, investments, business travel, etc.

That third category is what turns 6,000 direct reporters into data magnets for the entire global economy.

Every large company that sells components, transports goods, provides packaging, offers financing, or manages facilities for those reporters will find itself quantified within someone else’s Scope 3 ledger.

Network Effect of Disclosure

| Refrigerant leak detection and compliance solutions | Type of Entity | Relationship to SB 253 Reporter and the real cost of a refrigerant leak | How They’re Captured |

|---|---|---|---|

| Tier 1 Suppliers | Raw materials, logistics, OEMs | Direct the vendor to the reporter | Must provide verified emissions factors (EFs) or activity data |

| Tier 2–3 Suppliers For those seeking to improve HVAC system efficiency, check out these top techniques for detecting refrigerant leaks in HVAC. | Sub-suppliers & contractors | Indirect inputs | Data demanded via procurement portals |

| Downstream Partners | Retailers, distributors, service providers | Part of the value chain | Included through the use-phase or transport emissions |

| Financial Counterparties | Banks, insurers, asset managers | Financed or insured emissions | Captured through portfolio exposure under ISSB S2 |

📌 Result: The 6,000 companies at the core of CARB’s regime create a disclosure gravity well that draws in most of the remaining 45,000 global large enterprises (and countless SMEs) through procurement and reporting dependencies.

Scope 1 emissions, the foundation of this disclosure network, represent direct greenhouse gas emissions from sources that a company owns or controls. This includes emissions from combustion in owned or controlled boilers, furnaces, vehicles, and other equipment, as well as emissions from chemical production in owned or controlled process equipment.

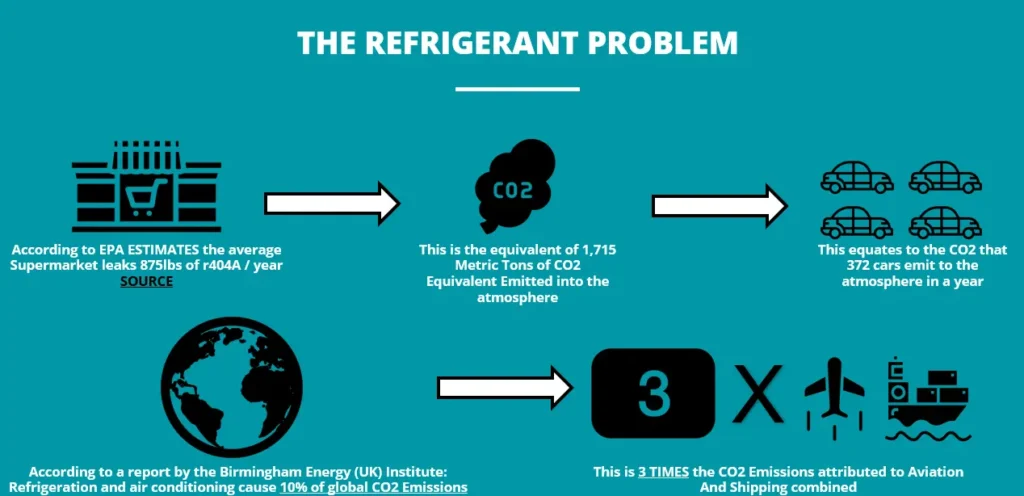

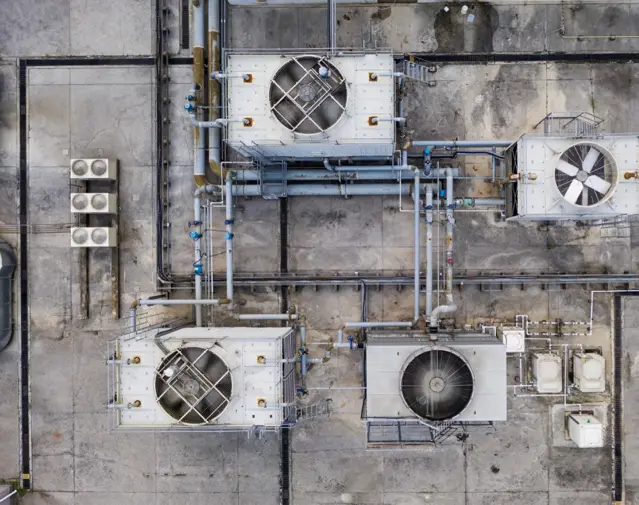

These operational measurements are typically the most tangible and immediate sources of emissions within a company’s control, including the use of leak detectors, making them critical for both compliance and internal management. Example: Refrigerant Leak Detection in Grocery Retail

A practical illustration of the importance of Scope 1 emissions measurement can be seen in the grocery retail sector, where refrigerant leaks are a significant source of greenhouse gas emissions.

For instance, major grocers like Walmart have reported that over 55% of their Scope 1 emissions stem from refrigerant-related sources.

This highlights the critical role of effective refrigerant leak detection and management systems in reducing emissions and complying with CARB’s disclosure requirements.

Scope 1 emissions reveal direct operational impact and compliance risk. Optimize leak detection and strengthen CARB-aligned reporting systems.

Automated Leak Detection Systems (AEOs), including advanced NDIR (Non-Dispersive Infrared) leak systems, are increasingly being adopted by grocery chains to monitor refrigerant leaks in real time. These leak detectors help identify and quantify refrigerant leaks promptly, enabling rapid response and repairs.

Incorporating such technologies into HVACR (Heating, Ventilation, Air Conditioning, and Refrigeration) maintenance programs is essential for facility management teams aiming to minimize emissions, maintain regulatory compliance, and reduce operational costs.

Moreover, compliance with evolving refrigerant management regulations, such as the EPA’s rules, the AIM Act, and state-specific mandates like California Refrigerant Management and similar mandates in Washington State and New York Refrigerant Management, requires grocers and other facility operators to maintain rigorous leak detection and repair protocols.

By integrating refrigerant leak detection into their environmental reporting and operational practices, companies can significantly lower their carbon footprint and enhance sustainability performance in line with CARB’s Phase 1 and Phase 2 disclosure frameworks.

An advanced NDIR leak detection system used in HVACR maintenance

This example underscores the intersection of operational emissions data, regulatory compliance, and facility management in sectors like grocery retail, where refrigerant leaks represent a major emissions risk and a key target for emissions reduction strategies.

As CARB’s disclosure requirements take hold, the extensive network effect means that Scope 1 data collection and verification will become embedded within normal operational measurements across the supply chain.

Over time, this integration will provide companies not only with the raw emissions data but also with a valuable juxtaposition: the ability to compare operational performance against emissions outcomes.

This dual insight enables organizations to evaluate the effectiveness of investments in infrastructure upgrades, energy efficiency, and emissions reduction technologies with greater precision.

By aligning Scope 1 emissions tracking with operational metrics, companies can identify inefficiencies, benchmark progress, and make data-driven decisions that enhance both environmental and financial performance.

The ripple effect of CARB’s disclosure gravity well thus transforms emissions measurement from a regulatory obligation into a strategic asset, fostering transparency and accountability throughout the global industrial ecosystem.

Quantitative Reach

- Roughly 75–80 % of global corporate emissions reside in Scope 3 categories.

- Each of the 6,000 primary reporters has, on average, 2,000–3,000 material suppliers.

- Even with overlap, the network touches > 200,000 enterprises worldwide; essentially the entire upper-tier industrial ecosystem.

- As suppliers submit verified emissions data to their largest customers, they will need Scope 1 and 2 tracking systems themselves, creating a chain reaction of digital measurement adoption.

Market Implications

- Data Infrastructure Proliferation

Software providers, IoT platforms, and analytics firms will see massive demand for supplier-level carbon accounting, from sensor-based tracking to AI-assisted life-cycle modeling. - Verification and Audit Expansion

Third-party assurance will move from the Fortune 500 to mid-market suppliers; verification capacity must grow by an order of magnitude. - Financing and Risk Pricing

Once Scope 3 disclosures integrate into financial risk assessments (SB 261), carbon intensity becomes a pricing factor in loans, insurance, and supply contracts. - Policy Convergence

The same datasets required by CARB will satisfy EU CSRD, ISSB, and UK Transition Plan mandates, driving global standardization.

Strategic Interpretation

Scope 1 reporting creates the signal; Scope 3 reporting amplifies it.

California’s disclosure regime ensures that even companies not directly listed must begin building:

- Internal carbon ledgers capable of exporting verified data to customers, and

- Governance processes for third-party assurance and digital traceability.

In practice, this turns the world’s supply chain into an extended compliance perimeter.

The 6,000 direct reporters are the regulatory front line, but the Scope 3 ripple converts almost every major commercial actor into a de facto data contributor.

The Global Reality

By 2027–2028:

- The 45,000 remaining large enterprises will appear in part or in full within CARB-aligned disclosures.

- Combined, the network will cover virtually 100 % of corporate emissions and ≈ 80 % of global GDP in transactional reporting links.

- For investors and regulators, California’s framework becomes the central clearinghouse for operational carbon data, a global utility for non-financial information.

When Oversight Becomes Infrastructure: Three Precedents for California’s Climate Disclosure Era

Dodd-Frank §1502 (Conflict Minerals): The Supply-Chain Cascade

What it did:

- Required SEC-registered companies to trace the origin of 3TG minerals (tin, tantalum, tungsten, gold).

- Created a paper trail from publicly traded manufacturers down to small smelters and mines.

- Within three years, more than 80 % of affected filers built or joined supplier-data portals; over 300,000 suppliers were reporting into them.

Market transformation:

- “Compliance” became a software market: dozens of supplier-disclosure platforms (Assent, Source Intelligence, iPoint) emerged.

- Transparency pressures reached well beyond the SEC universe, and private suppliers changed sourcing to stay eligible.

Parallel to SB 253/261:

- Scope 3 reporting is the next-generation cascade: once 6,000 primary reporters file, their entire vendor base will need verifiable carbon data.

- Expect the same evolution: procurement contracts as regulatory levers, and a global ecosystem of carbon-data platforms replacing mineral-tracking portals.

Past disclosure rules reshaped supply chains through transparency. SB 253/261 will extend this shift to carbon data. Prepare your reporting systems.

Sarbanes-Oxley (SOX): Building the Assurance Economy

What it did:

- Section 404 required CEOs, CFOs, and auditors to attest to the effectiveness of internal financial controls.

- Created the modern “controls and assurance” industry, governance software, audit analytics, and third-party testing firms.

- Within five years, audit fees and IT-governance spending doubled, but market confidence and data reliability rose dramatically.

Market transformation:

- Internal control frameworks (COSO, COBIT) became global corporate standards.

- Assurance migrated from finance to IT, cybersecurity, and ESG.

Parallel to SB 253/261:

- Mandated third-party GHG verification will create a comparable assurance market for emissions data:

- Verification and validation bodies (VVBs) function as “carbon auditors.”

- Companies invest in internal carbon-control systems, document retention, evidence chains, and audit-ready registries.

- In short, SOX built the template for governance infrastructure; SB 253 will extend it to non-financial data.

The U.S. NOₓ and SO₂ Trading Programs: Markets That Cleaned the Air

What they did:

- Title IV of the 1990 Clean Air Act Amendments established the first cap-and-trade system for SO₂ (Acid Rain Program), later extended to NOₓ.

- Required continuous emissions monitoring and verified allowance trading.

- By 2010, SO₂ emissions fell > 40 %, while electricity prices remained stable, proof that verified data + price signals could decouple regulation from cost escalation.

Market transformation:

- Spawned emissions-trading desks, allowance exchanges, and continuous-monitoring technology markets.

- Verification hardware and software became standard equipment for every power plant.

Parallel to SB 253/261:

- California’s disclosure regime won’t trade carbon allowances, but it creates the same underlying infrastructure:

- Verified, time-stamped Scope 1 data = the foundation for future carbon pricing.

- Once every major emitter has audit-grade operational data, financial markets can price carbon risk as they now price sulfur and nitrogen.

The Combined Signal

| Historical Policy | Core Mechanism | Market Outcome | Forecast for SB 253 / 261 |

|---|---|---|---|

| Dodd-Frank §1502 | Supplier due diligence & public disclosure | Supply-chain traceability software; procurement as compliance | Global Scope 3 data-sharing networks |

| Sarbanes-Oxley §404 | Mandatory internal control attestations | Assurance industry; governance software | Carbon-data audit & verification markets |

| NOₓ / SO₂ Trading | Measured emissions + tradable rights | Cap-and-trade ecosystem; monitoring tech | Priceable, verifiable carbon metrics enabling risk valuation |

Synthesis

Each of these programs began as a narrow compliance rule and evolved into market infrastructure.

- Conflict-minerals reporting digitized supplier networks.

- SOX created enterprise-control systems and a global assurance profession.

- NOₓ/SO₂ trading proved that verified emissions data could underpin functioning markets.

SB 253 / 261 will merge all three dynamics: supplier transparency, verified data governance, and market-grade measurement.

Together they signal that carbon disclosure is becoming not just an environmental requirement but the next architecture of global financial information.

Solutions: Leveraging NDIR Technology and AKO’s Expertise for Effective HVAC Emissions Management

Addressing the challenges of refrigerant leaks and emissions in sectors like HVAC (Heating, Ventilation, Air Conditioning) and HVACR maintenance is critical to meeting CARB’s disclosure requirements under SB 253 and SB 261.

One of the most effective tools for tracking and managing these emissions is the use of advanced Non-Dispersive Infrared (NDIR) leak detection systems, often referred to as ndir leak system.

NDIR technology provides real-time, accurate monitoring of refrigerant leaks, enabling swift identification and remediation to reduce greenhouse gas emissions significantly.

AKO, a leader in environmental monitoring solutions, brings extensive experience from both European and U.S. markets in deploying NDIR leak detection systems that integrate seamlessly into facility management operations.

Their expertise spans various industries, including supermarkets, data centers, and commercial buildings, where HVAC and HVACR systems represent a substantial portion of operational emissions.

By implementing AKO’s solutions, companies can enhance their refrigerant leak detection capabilities, ensuring compliance with evolving refrigerant management regulations such as California Refrigerant Management and similar mandates in Washington State and New York.

Solutions by Rank

| Rank | Solution | Sector | Total Atmospheric CO₂-EQ Reduction (GT) | Net Cost (Billions US$) | Savings (Billions US$) |

|---|---|---|---|---|---|

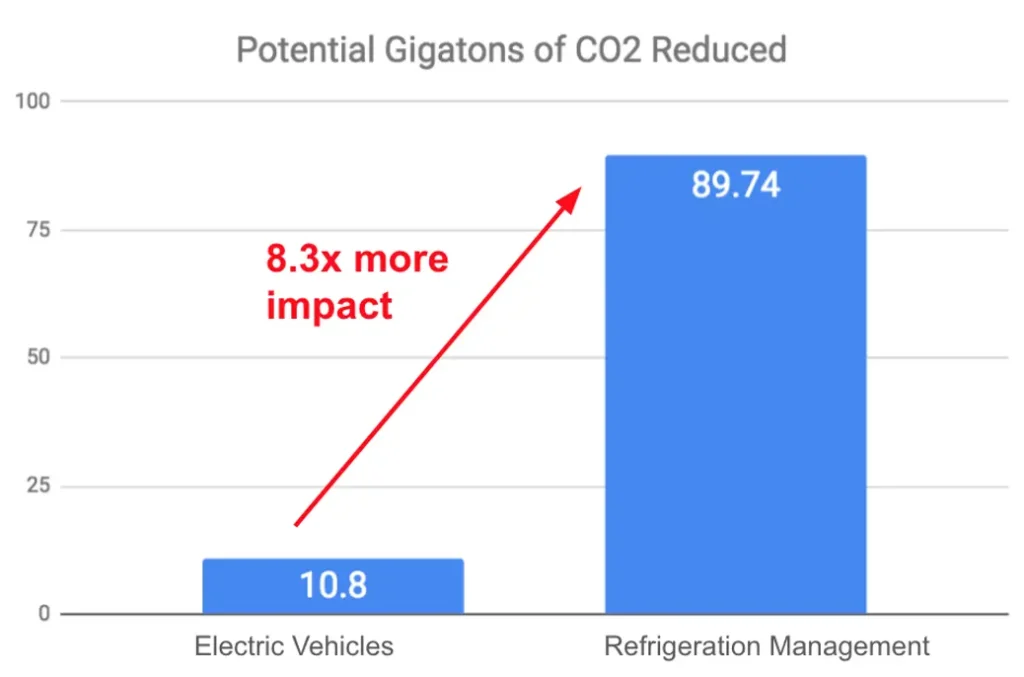

| 1 | Refrigerant Management | Materials | 89.74 | N/A | $902.77 |

| 2 | Wind Turbines (Onshore) | Electricity Generation | 84.60 | $1,225.37 | $7,425.00 |

| 3 | Reduced Food Waste | Food | 70.53 | N/A | N/A |

| 4 | Plant-Rich Diet | Food | 66.11 | N/A | N/A |

| 5 | Tropical Forests | Land Use | 61.23 | N/A | N/A |

| 6 | Educating Girls | Women and Girls | 59.60 | N/A | N/A |

| 7 | Family Planning | Women and Girls | 59.60 | N/A | N/A |

| 8 | Solar Farms | Electricity Generation | 36.90 | $80.60 | $5,023.84 |

| 9 | Silvopasture | Food | 31.19 | $41.59 | $699.37 |

| 10 | Rooftop Solar | Electricity Generation | 24.60 | $453.14 | $3,457.63 |

AKO’s advanced NDIR leak detection system deployed in commercial facilities

The impact of HVAC and HVACR maintenance on a company’s overall emissions profile is profound. Refrigerant leaks contribute significantly to Scope 1 emissions, and failure to manage these leaks effectively poses hidden risks that can affect a company’s reputation, regulatory compliance, and ultimately, its financial valuation.

For investors, the visibility provided by accurate and timely emissions reporting is crucial to assessing climate-related financial risks. The concept of overall survival in today’s competitive business environment increasingly depends on how well companies manage and disclose these risks.

By adopting advanced NDIR leak detection technology and partnering with experienced providers like AKO, businesses can transform their emissions management from a regulatory obligation into a strategic advantage.

Transparent, verified reporting not only mitigates hidden risks but also builds investor confidence by offering a clear, clean view of a company’s environmental performance.

This proactive approach to HVAC-related emissions aligns with CARB’s Phase 1 and Phase 2 disclosure frameworks, positioning companies for long-term resilience and success in an era where climate risk is a critical factor in investment decisions.

If Phase 2 lifts CARB’s universe to ~6,000+ filers, where (specifically) does our nexus get triggered (sales, property, payroll), and what is our legal-entity map that proves or refutes inclusion?

The nexus for reporting under CARB’s SB 253 and SB 261 is triggered by meeting any of the California Franchise Tax Board’s (FTB) § 23101 “doing business” thresholds:

- Sales in California: Over $690,144 gross receipts

- Property in California: Assets over $69,015

- Payroll in California: Compensation over $69,015

- 25% Rule: More than 25% of total sales, property, or payroll in California

CARB’s preliminary list mainly uses California Secretary of State registrations and Dun & Bradstreet revenue data, resulting in dominance by entities incorporated in California or Delaware. However, companies operating in California without local registration (such as out-of-state subsidiaries or foreign parents) may be excluded despite meeting nexus criteria.

To confirm inclusion, companies should review their corporate structures by:

- Identifying all legal entities and registration jurisdictions

- Mapping California-based sales, property, and payroll per entity

- Assessing parent-subsidiary relationships to avoid duplication or omission

- Comparing data against FTB thresholds to determine reporting obligations

This thorough legal-entity and economic presence analysis is vital for compliance preparation and alignment with CARB’s evolving disclosure requirements.

What is Our Current Scope 1 Control Environment?

Ensuring SOX-Ready Independent Verification under SB 253.

Understanding and strengthening our Scope 1 control environment is critical to meeting CARB’s SB 253 disclosure requirements with confidence and commercial advantage.

This involves clearly identifying who is responsible for attesting to emissions data, the systems that generate these figures, and how robust our evidence trail is to support independent verification, akin to the rigorous SOX (Sarbanes-Oxley) compliance standards investors expect.

Key considerations include:

Accountability

Assigning dedicated personnel to oversee emissions data collection and attestation, ensuring ownership and transparency.

Data Systems

Leveraging integrated operational platforms that capture real-time emissions data from HVAC, HVACR, fleet operations, and refrigerant leak detection systems, including advanced NDIR leak systems, to produce accurate, auditable numbers.

Audit-Ready Documentation

Maintaining comprehensive records, logs, and controls that create a clear, traceable evidence chain for third-party verifiers, minimizing the risk of non-compliance and costly penalties.

By proactively optimizing our Scope 1 emissions control environment with SOX-level rigor, we not only comply with CARB’s evolving regulatory framework but also enhance investor confidence, reduce audit costs, and position our business competitively in California’s dynamic market.

This strategic approach transforms regulatory compliance from a cost center into a value driver, supporting sustainable growth and market leadership.

Building audit-ready emissions systems strengthens compliance and investor trust. Design accountable, data-driven reporting aligned with CARB standards.

Which Tier-1 suppliers will we require to provide supplier-specific EFs or activity data in 2026, and what’s our contractual plan (terms, portals, service levels) to make it happen?

This marks a structural shift: suppliers will no longer be able to rely on generic estimates or industry averages. Each must determine how to collect and verify its own emissions data. There are three practical paths forward:

DIY Path

Suppliers build internal capacity by assigning accountability for Scope 1 and Scope 2 tracking, aligning facility energy data, leak logs, and equipment records into a simple emissions ledger. This works best for smaller operators that have direct control over limited sites or fleets.

Third-Party Outsource

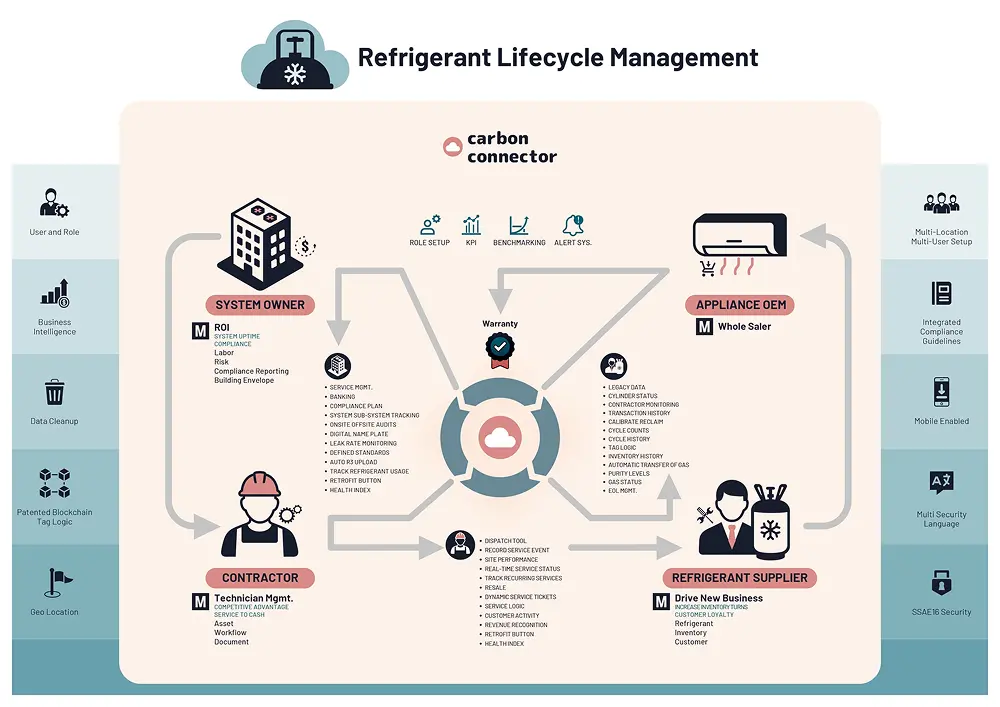

Vendors engage specialists (such as environmental consultants, compliance firms, or platform providers like Carbon Connector’s LDaaS and AKO’s NDIR leak detection systems) to generate verified, audit-grade data. This approach streamlines accuracy but requires budget planning and coordination.

Hybrid Model

The most scalable route for multi-site or multi-region operators. Internal teams manage ongoing data capture while external partners verify and format data for submission, creating a blend of ownership and assurance.

To ensure alignment, companies should review and update supplier contracts and service agreements now, inserting clear clauses that:

- Define emissions-reporting deliverables and deadlines aligned with 2026 submission cycles.

- Specify acceptable verification methods (metered data, third-party audits, or certified leak detection reports).

- Outline minimum data quality standards, documentation formats, and penalties or incentives for compliance.

A minimum viable program (MVP) can set the tone: select a small group of high-impact vendors, pilot the reporting process, test digital portals, and refine templates for contracts and data exchange. This early effort establishes benchmarks.

Among the major operational levers (refrigerants, stationary combustion, and fleet operations), the greatest near-term abatement impact comes from addressing refrigerant losses.

Among the major operational levers, refrigerants deliver the biggest bang for your buck in the mitigation roulette. They combine high global-warming potential with clear lines of measurement, making leak prevention and recovery the most immediate (and verifiable) path to emissions reduction. Every pound of refrigerant retained represents thousands of pounds of CO₂e avoided, and that’s where the data, dollars, and disclosures all align.

Modern leak detection systems transform this advantage into a quantifiable performance metric. Through LDaaS (Leak Detection as a Service), continuous NDIR-based sensors capture leak events in real time, producing time-stamped, verifiable data that can be directly audited under CARB, CSRD, and ISSB frameworks. It’s not just monitoring, it’s measurement with evidence.

Tag Wizard complements that process by maintaining a living inventory of equipment and activity records, linking each unit’s refrigerant charge, maintenance events, and leak history to its compliance profile. Together, these tools provide the infrastructure to track, validate, and document reductions with the same rigor as financial controls.

While stationary combustion upgrades and fleet electrification provide steady long-term gains, refrigerant containment remains the highest-yield operational play, offering immediate CO₂e impact, audit-ready data, and continuous performance feedback.