California’s Climate Accountability Package

Table of Contents

ToggleNavigating Emissions Obligations

Including Refrigerant Leaks, and Fostering Dialogue in the Wake of the May 2025 CARB Deliberations

The May 29, 2025, virtual workshop hosted by the California Air Resources Board (CARB) highlighted the opportunities and considerable challenges associated with implementing California’s landmark Climate Accountability Package—Senate Bills 253 and 261.

The bill introduces specific obligations for companies, such as disclosures on climate-related risks and emissions, and has recently undergone legislative updates and amendments before becoming law.

These bills, which have passed the legislative process and are now law, form the backbone of California’s new climate disclosure requirements.

This pivotal event, attended by over 3,000 stakeholders, underscored the urgency for large companies doing business in California to prepare for extensive new requirements.

These include the disclosure of greenhouse gas (GHG) emissions, emphasizing direct sources like refrigerant leaks and climate-related financial risks.

This policy piece, informed by that key meeting and the full suite of available documentation, analyzes how entities can navigate these groundbreaking obligations.

It emphasizes the profound significance of these laws in elevating climate disclosures to a level of rigor akin to financial reporting.

A critical aspect of this enhanced accountability involves robust systems for leak detection and tracking refrigerant leaks in real-time, which are essential for improving corporate awareness and disclosures’ verifiability.

The discussion will explore how this new era of transparency, particularly concerning historically underreported operational details like refrigerant management, is set to foster a more informed and open dialogue on corporate climate impact and responsibility.

The reporting platform and resulting GHG emissions data must be accessible to all stakeholders, ensuring transparency and accountability, and it is the company’s responsibility to publicly disclose environmental data, offset information, and validation details on its website, especially in relation to emissions reporting requirements.

Timeline: Rulemaking Process

| Phase | Details | Notes |

|---|---|---|

| Climate Disclosure Program Direction & Development | • 2023: California Legislature passed, and the Governor approved two pieces of legislation: SB 253 and SB 261 • 2024: SB 219 amended both and extending deadlines • 2024-25: CARB information solicitation | Legislative direction and CARB information solicitation |

| Climate Disclosure Pre-Rulemaking | Informal Workshops • Identify regulatory concepts • Discuss alignment with legislative intent • Solicit public and stakeholder input | Public workshops to develop concepts aligned with State goals |

| Climate Disclosure Formal Rulemaking | • SRIA Released • Issue Notice of Proposed Rulemaking * a. Draft regulatory text b. Initial Staff Report c. Environmental and economic analyses • 45-day comment period • Potential additional amendments and 15-day comment period • Adoption by CARB at Board Hearing • Final Staff Report with comment response • Office of Administrative Law review • Implementation begins | Formal process with specific timelines * By law, CARB has one year to complete the final rule once the initial proposal is published. |

Despite CARB’s ongoing rulemaking process and reports suggesting that the July 1, 2025, deadline for issuing detailed implementation guidelines may be unachievable, the statutory reporting timelines for companies, beginning in 2026 for FY2025 Scope 1 and 2 emissions under SB 253, have been emphatically reaffirmed by legislative authors.

This context makes proactive preparation, including the enhancement of systems for managing and reporting on refrigerants and leaks, essential for affected entities.

Companies must determine if they qualify to do business in California based on legislative criteria, and it is determined whether a company is subject to the new regulations by assessing these requirements.

A New Paradigm: California’s Leap to Financially Rigorous Climate Accountability

California’s Climate Accountability Package (SB 253 & SB 261) establishes the first comprehensive, legally mandated climate-related corporate accountability and financial risk disclosure framework in the United States.

This legislation is rooted in the understanding that corporations play a critical role in addressing GHG emissions, with studies attributing over 70% of historical emissions to business activities, and that a current lack of transparency can allow large corporations to evade regulatory scrutiny and mislead stakeholders.

The overarching intent is to re-establish California’s climate leadership by mandating increased transparency regarding corporate emissions and climate-related investments.

A core innovation of these laws is their aim to shift climate disclosures from the often voluntary, unaudited, and marketing-oriented realm of some traditional ESG reporting towards a system reflecting the rigor and verifiability of financial accounting.

As detailed in the “Climate Policy that reflects the framework of financial reporting.docx,” this involves:

Challenging “Business as Usual” Financial Reporting

Traditional financial metrics often overlook the significant non-financial environmental impacts of operations, such as fugitive refrigerant emissions, process leaks, or energy waste.

SB 253 and SB 261 compel the integration of these environmental repercussions with financial data, ensuring that if cost-cutting measures lead to increased emissions, this trade-off becomes transparent.

💬 “Just like monthly financials keep spending in check, refrigerant leaks need real-time oversight. With online meters like AKO, you don’t wait for year-end surprises—you see the problem as it happens and fix it fast.” — Ted Atwood.

Mandating Verifiable Accuracy and Combating Greenwashing

These laws institute a level of validation akin to financial audits by requiring third-party assurance for emissions data.

This is designed to protect consumers and investors from “greenwashing”—exaggerated or unsubstantiated environmental claims—and ensure that disclosures are accurate, honest, and reliable.

Regular review of emissions data and disclosures is necessary to maintain accuracy and compliance.

💬 “These regulations aren’t about feel-good environmentalism—they’re about accountability, recordkeeping, and awareness. If a company like Microsoft can’t explain its emissions spike, that’s a sign of missing internal visibility. This framework forces organizations to know what they should already know.” — Ted Atwood.

Key Elements of the Legislative Framework

The Climate Accountability Package includes core elements such as mandatory GHG emissions disclosure, third-party assurance, climate-related financial risk reporting, and alignment with global standards.

This approach ensures that corporate reports offer a multifaceted view of performance, allowing stakeholders to make informed decisions based on financial stability and genuine environmental stewardship.

To enhance transparency further, the company’s environmental impact and emissions management strategies should be published on its website.

This is very important since these reports are often seen as environmental, altruistic, or principled, but they are none of these things. ESG reporting, on the surface, has been wrongly defined.

These reports should be considered non-financial reports that help investors and shareholders better understand a company’s performance.

Core Mandates of the Climate Accountability Package (SB 253 & SB 261)

SB 253 (Climate Corporate Data Accountability Act)

Authored by Senator Wiener, this act mandates that U.S.-formed business entities (including partnerships, corporations, and LLCs) with over $1 billion in annual global revenue that “do business in California” must publicly disclose their GHG emissions annually, adhering to the Greenhouse Gas (GHG) Protocol standards.

Companies may report at the parent level to streamline disclosures for large corporations.

Emissions Scopes

Scope 1

Direct GHG emissions from sources owned or controlled by the company. This explicitly includes fugitive emissions such as refrigerant losses from HVAC/R systems of any size (no weight thresholds for reporting these losses are specified), emissions from fuel combustion in company vehicles and facilities, and process emissions.

The “Comprehensive_Condensed_Slide_Deck.docx” and “Policy_Brief_SB253_SB261.docx” documents emphasize the materiality of refrigerant leaks as a Scope 1 component, particularly in sectors like retail, data centers, and hospitality.

Identifying and documenting data sources is essential for accurate GHG calculations and traceable reporting.

Scope 2

Indirect GHG emissions from the generation of purchased electricity, steam, heat, or cooling. This also includes refrigerant emissions from purchased cooling from district or third-party systems.

Scope 3

All other indirect emissions occurring in a company’s value chain, including purchased goods and services, capital goods, fuel- and energy-related activities not included in Scope 1 or 2, transportation and distribution (upstream and downstream), waste generated in operations, business travel, employee commuting, leased assets (upstream and downstream), processing of sold products, use of sold products, end-of-life treatment of sold products, franchises, and investments.

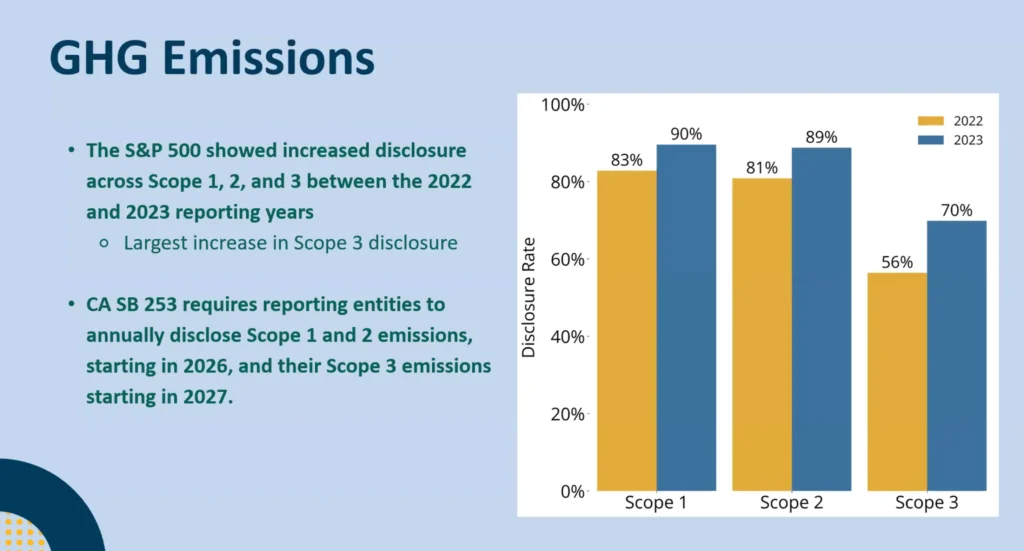

Reporting Timelines

- Scope 1 and 2 emissions reporting commences in 2026 (for the 2025 emissions year)

- Scope 3 reporting begins in 2027 (for the 2026 emissions year).

Assurance

A phased approach to third-party assurance is mandated: limited assurance for Scope 1 and 2 emissions from 2026, transitioning to reasonable assurance by 2030. CARB is also to evaluate Scope 3 verification requirements, possibly introducing limited assurance by 2027.

SB 261 (Climate-Related Financial Risk Disclosure Act)

Authored by Senator Stern, this act applies to U.S.-formed business entities with over $500 million in annual global revenue that “do business in California,” requiring them to submit a biennial report on their climate-related financial risks.

Risk Reporting Framework

Reports must align with the TCFD recommendations (or optionally ISSB standards or other approved frameworks) and cover governance, strategy, risk management, and climate-related metrics and targets.

The Task Force on Climate-related Financial Disclosures (TCFD) plays a central role in shaping these disclosure standards.

Definition of Risk

“Climate-related financial risk” includes material physical risks (e.g., from wildfires, droughts, extreme heat, and other extreme weather events) and transition risks (e.g., from policy changes like refrigerant phase-downs under the AIM Act, market shifts, technological obsolescence) affecting various aspects of the business. Building resilience to climate-related challenges is a key objective of these requirements.

Reporting Timeline

The first report is due by January 1, 2026. CARB is mandated to contract with a nonprofit climate reporting organization by January 1, 2025, to assist in developing the disclosure framework.

SB 219 is a “clean-up” bill.

It adjusts two major climate laws passed in 2023 — SB 253 and SB 261 — which require large companies doing business in California to report greenhouse gas (GHG) emissions and climate-related financial risks.

California Senate Bill 219 (SB 219), signed into law on September 27, 2024, modifies the state’s landmark climate disclosure laws—SB 253 and SB 261—by granting the California Air Resources Board (CARB) more time and discretion to implement them.

These original laws require large U.S. companies that do business in California to report greenhouse gas (GHG) emissions (SB 253) and disclose climate-related financial risks (SB 261).

While the reporting deadlines remain unchanged, SB 219 extends CARB’s deadline to finalize implementation rules from January 1, 2025, to July 1, 2025, meaning companies will begin collecting 2025 data without clear regulatory guidance.

In addition to the delay, SB 219 gives CARB flexibility over key aspects of program design. CARB may now choose when Scope 3 emissions must be reported, receive reports directly or delegate to a third party, and allow subsidiaries to consolidate reports with parent companies under SB 253 (as was already permitted under SB 261).

SB 219 also removes the requirement to pay filing fees at the time of submission, though it does not eliminate the fees themselves—they remain due by January 1, 2026, for SB 261, and at a future date for SB 253.

Although SB 219 aims to support smoother implementation, it has introduced uncertainty for companies preparing to comply with California’s climate disclosure regime.

The law creates a situation where companies must collect and organize climate data, especially Scope 1 and 2 GHG emissions, before knowing precisely how the state will expect them to report.

With the first compliance periods rapidly approaching and ongoing litigation potentially altering the program’s trajectory, affected companies should begin auditing their emissions and financial risk exposure now and consult with legal and technical advisors to stay ahead of California’s evolving climate accountability landscape.

Financial Disclosures: Integrating Climate Risk into Corporate Reporting

As California’s climate regulations take effect, companies with annual revenues of $500 million or more are now required to incorporate climate-related financial disclosures into their core reporting processes.

The California Air Resources Board (CARB) has established clear guidelines aligning with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, ensuring companies systematically identify, assess, and disclose climate-related financial risks.

These risks are broadly categorized into physical climate-related risks—such as those posed by wildfires, droughts, and other extreme weather events—and transition climate-related risks, including regulatory changes, market demand shifts, and technological advancements.

By integrating climate risk into their financial reporting, companies can enhance their risk management strategies and provide stakeholders with a transparent view of how climate-related risks and opportunities are being addressed.

The TCFD framework encourages companies to disclose their exposure to risks and their use of voluntary carbon offsets and other sustainability strategies to reduce greenhouse gas emissions.

This level of transparency is essential for building trust with investors, regulators, and the public and for ensuring that companies are prepared to navigate the evolving landscape of climate-related risks in California and beyond.

Ultimately, robust climate-related financial disclosures enable companies to demonstrate accountability, align with best practices, and proactively manage the financial impacts of climate change.

🌍 Ready to strengthen your climate-related financial reporting?

Stay ahead of California’s evolving climate regulations by aligning your disclosures with TCFD best practices. Explore our resources and see how we can help your organization integrate climate risk into corporate reporting.

The Audience at the May 2025 CARB Workshop: Profile, Perspectives, and Key Moments

Audience Profile

Attendees represented a wide spectrum of stakeholders, including over 3,000 individuals registered for the workshop, with Senator Stern noting participation from at least five continents.

Reporting Entities & Industry Associations

Numerous companies are potentially subject to the laws, and trade groups such as the:

- California Municipal Utilities Association (CMUA),

- Association of Independent California Colleges and Universities (ASCCU),

- AdvaMed (medical technology),

- Investment Company Institute (ICI),

- American Clean Power Association (ACPA-CA), and;

- CalCPA/AICPA.

Financial Sector & Investors

Representatives from financial services firms, investment managers, and investor groups like Ceres and CalPERS.

Standard-Setting & Expert Bodies

Individuals from organizations like the International Sustainability Standards Board (ISSB), XBRL US, The Climate Registry, Carbon Disclosure Project (CDP), and the ANSI National Accreditation Board (ANAB).

Sustainability Consultants & Legal Professionals

Numerous consultants and law firms are advising clients on these upcoming regulations.

Verification and Assurance Providers

Firms involved in GHG verification, such as Omniē ESG and York Engineering.

Environmental & Advocacy Organizations include groups like the Environmental Defense Fund (EDF), Californians Against Waste, and Carbon Accountable.

Academics

Researchers from institutions like the UCLA Anderson School of Management.

Government Officials & Concerned Citizens

Staff from various agencies and individual residents.

What They Had to Say: Key Stakeholder Perspectives from the May 29 Workshop

Overarching Concern for Clarity and Feasibility

A dominant theme was the urgent need for clear definitions from CARB (especially “doing business in California” and “revenue”) and practical reporting timelines, given the proximity of the 2026 start date and the current stage of rulemaking.

As Melinda Rouch, representing a large private company, stated, a January 1, 2026, reporting deadline without finalized definitions much earlier would “not be reasonable or fair”.

Harmonization is Paramount

Virtually all stakeholder groups, from industry (e.g., Darby Gottl[e]y for AdvaMed ) to investors (e.g., Jake Raskoff for Ceres), strongly advocated for CARB to align its regulations with existing global standards (GHG Protocol, TCFD, ISSB, EU CSRD, SEC rules) to minimize duplicative efforts and reduce compliance burdens.

Data Challenges (Scope 3 & Refrigerants)

Many expressed concerns about the complexities of Scope 3 data collection and the specific challenges of accurately tracking and reporting Scope 1 refrigerant emissions.

Daniel Larson from a construction company questioned the availability of local emission factors and potential double-counting.

Identifying, organizing, and documenting data sources was highlighted as critical for accurate and traceable emissions calculations.

Assurance and Verification

Assurance providers (e.g., John Schheidler of Omniē ESG, Jason Fox of CalCPA/AICPA ) and reporting entities (e.g., Heather Wood of TTX Company) sought clarity on verifier qualifications, acceptable assurance standards, and how “good faith efforts” would interact with assurance, especially for initial, potentially incomplete reports.

Regular review of emissions data and disclosures was emphasized to ensure ongoing compliance and credibility.

Sector-Specific Impacts & Exemptions

Various sectors voiced unique concerns:

- Public utilities sought explicit exemption (Priscilla Kos, CMUA); nonprofit educational institutions argued for exclusion (Nick Romo, AICCU),

- Financial services and investment funds questioned revenue definitions and applicability (Patrick Joyce, ICI; Anna Farrow, Davis Wright Tremaine ),

- Construction companies raised issues of double-counting, and companies with remote California employees worried about being unintentionally swept into scope (Kristen Bandenberg; Richard Chandler).

Support for the Laws’ Intent

Despite implementation concerns, many, including environmental organizations (e.g., Stephanie Jones, EDF) and standard setters (e.g., Catherine Atkin, Carbon Accountable), expressed strong support for the objectives of SB 253 and 261 and California’s leadership.

🤔 Have questions or concerns about SB 253 and 261?

Connect with us to share your perspective and explore how we can help you prepare for compliance.

Key Moments from the Workshop

Legislative Reaffirmation

Opening remarks by Senator Scott Wiener and Senator Henry Stern emphasized California’s commitment to climate leadership and, crucially, Senator Wiener’s assertion that the statutory reporting timelines (2026 for Scope 1&2, 2027 for Scope 3) “are holding firm” and would not be delayed.

CARB’s Initial Concepts & Call for Input

CARB staff presented their initial thinking on critical definitions for “doing business in California,” “total annual revenue,” and “corporate relationships,” explicitly soliciting detailed stakeholder feedback to refine these concepts.

External Study Presentations

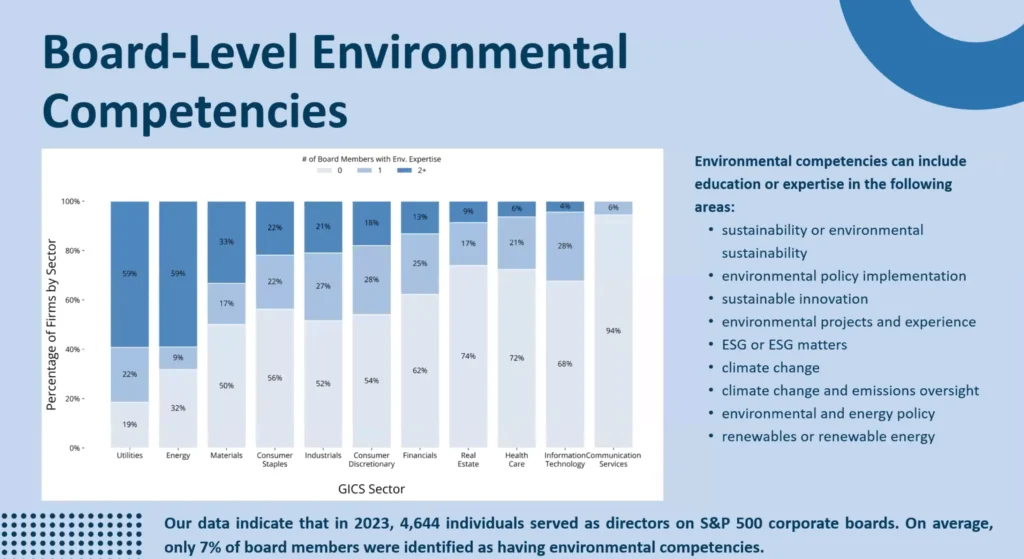

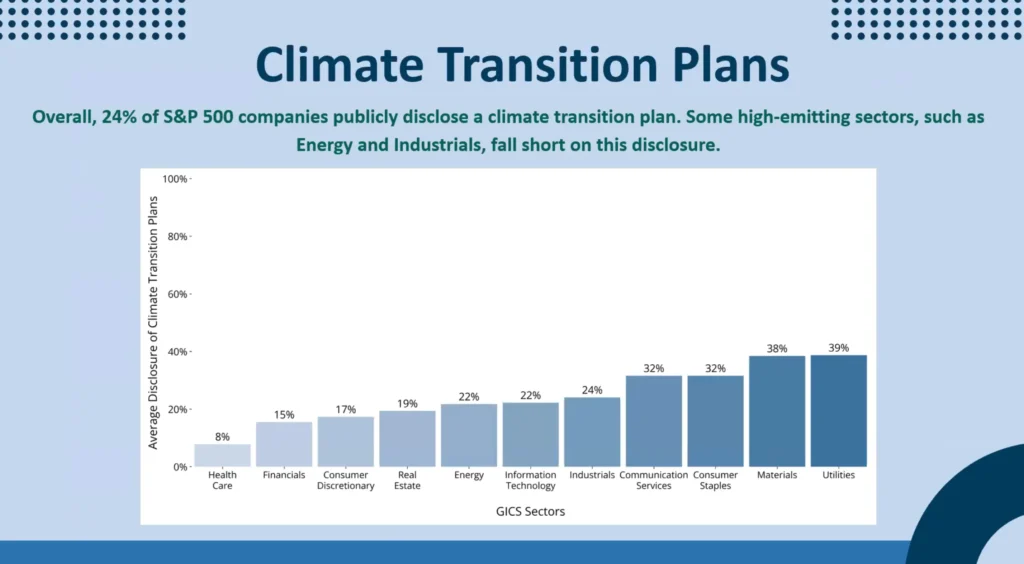

The findings from Montrose Environmental on existing GHG reporting programs and the UCLA Anderson School of Management on S&P 500 disclosure practices (highlighting significant data gaps, especially for Scope 3 and refrigerant emissions) provided crucial context, underscoring both existing practices and areas needing significant improvement.

Volume of Stakeholder Engagement

The sheer number of participants and the depth and breadth of questions and comments during the extended public comment period vividly illustrated the complexity, widespread impact, and high level of stakeholder concern and interest in the regulations.

Frustration was evident among stakeholders and legislators regarding the pace of regulatory implementation.

Timeline Realities

CARB’s acknowledgment of their ongoing, iterative rulemaking process aiming for regulation finalization by the end of 2025, juxtaposed with the Forbes article’s report (informed by the meeting) that the July 1, 2025, guideline deadline is unattainable, created a focal point of discussion around readiness and feasibility.

“Good Faith Efforts” Confirmation

CARB’s reiteration of its December 2024 enforcement notice, indicating no penalties in 2026 for incomplete Scope 1 & 2 reports under SB 253, provided companies demonstrate a “good faith effort”, offered some reassurance to companies facing the initial reporting cycle.

Organizations may also file lawsuits or complaints if they believe the regulations are not being implemented or enforced appropriately.

Navigating Implementation: Strategies for Meeting Obligations and Fostering Dialogue

Successfully meeting the requirements of SB 253 and SB 261 demands proactive and strategic preparation.

Data Collection, Management, and Governance

Companies must establish robust internal systems and governance for collecting comprehensive Scope 1, 2, and 3 emissions data.

This necessitates moving from estimations to performance-based data, especially for Scope 1 sources like refrigerants, where accurate tracking of leaks and service records across all assets is critical.

This aligns with the principle from the “Climate Policy…” document that only by considering both financial and environmental aspects can a full picture of operations be seen.

Compiling a detailed emissions inventory is essential for aligning with TCFD-aligned disclosures and decarbonization goals.

Robust tracking mechanisms, potentially leveraging specialized software, are vital for fugitive emissions like refrigerants.

Sources emphasize the inadequacy of only reporting EPA 608 data and the need for detailed, asset-level information. Identifying and organizing data sources supports accurate and verifiable GHG calculations.

Preparing for Assurance

The phased-in assurance requirements necessitate strong internal controls over data quality and reporting methodologies to withstand third-party scrutiny.

Stakeholders eagerly waited for CARB’s clarification on verifier qualifications and acceptable standards. Regular review of emissions data and disclosures is necessary to ensure ongoing compliance.

Integrated Climate Risk Assessment

For SB 261, entities must adopt a TCFD-aligned approach to identify and manage climate-related financial risks.

This includes understanding transition risks, such as those posed by refrigerant phase-downs under the AIM Act, and physical risks to operations and supply chains, including extreme weather events like wildfires and flooding.

Building resilience to these climate-related challenges is critical for long-term business continuity.

Inter-departmental Collaboration

Effective compliance requires breaking down traditional silos. ESG, finance, legal, operations (particularly facilities management for Scope 1/refrigerant data), and procurement teams must collaborate closely.

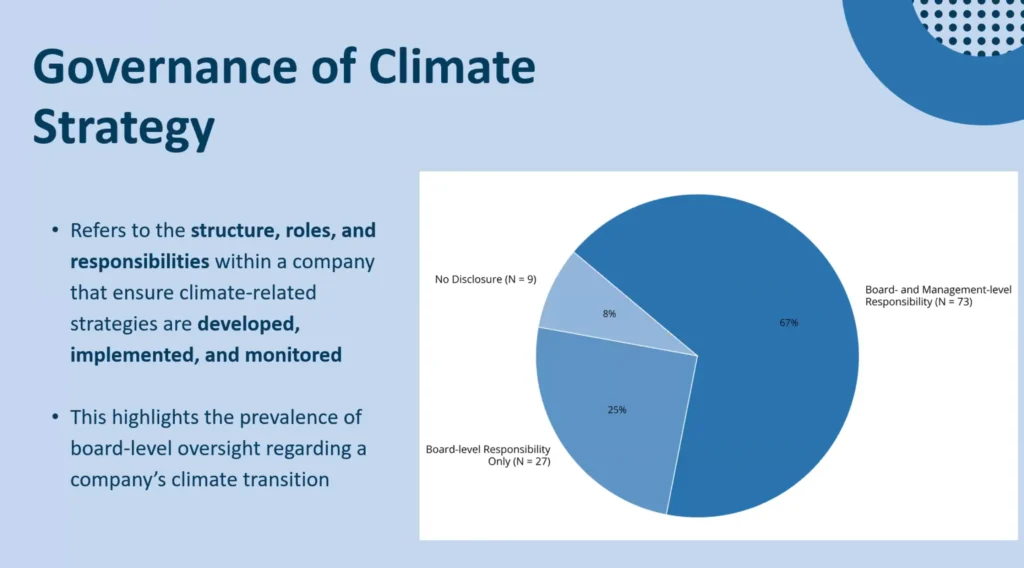

Governance structures must ensure board-level understanding and oversight of these integrated risks and disclosures.

Leveraging Existing Frameworks While Preparing for Specifics

While harmonization with global standards is a key stakeholder request, companies must prepare for California-specific definitions and the precision required by legally binding regulations, which may differ from more flexible voluntary standards.

Fostering Open Dialogue

The transparency facilitated by these laws creates an opportunity for more substantive dialogue with investors, customers, and regulators, based on verified data rather than unsubstantiated claims.

Companies should prepare to articulate their climate strategies and progress clearly.

The company’s website should be a central, accessible platform for publishing environmental impact and emissions management strategies.

Harmonization and Comparative Landscape

California’s initiatives are within a dynamic global context of evolving climate disclosure mandates.

| Comparison of Selected Programs Study of GHG program questions |

|---|

| Category | Questions |

|---|---|

| Activity Data Collection and Management | 1. How is the data collected? 2. Are there specific record-keeping procedures for activity data? 3. Does the program use actual data or estimated data? 4. What are examples of activity data? |

| Data Availability and Transparency | 1. Is the reporter required to submit their emissions data? 2. In the reported data publicly available? 3. Does this allow for year-over-year comparisons and cross comparisons with other programs? |

| Flexibility of Substitutes | 1. Does the program allow for substitutes in quantification methodology or data collection? 2. What is an example of a substitute used in emissions calculations? |

| Stringency and Reliability | 1. Is the reporter required to submit their emissions data? 2. Is the reported data publicly available? 3. Does this allow for year-over-year comparisons and cross comparisons with other programs? |

A key distinction between the SEC Climate Disclosure Rules and the California SB 253 and SB 261 lies in applicability: The SEC rules primarily targeted publicly traded companies, while California’s SB 253 and SB 261 extend to public and private companies meeting the revenue and “doing business in California” criteria.

Furthermore, SB 253’s mandate for Scope 3 reporting is more definitive than the SEC’s conditional approach.

THE SEC is in the process of adjusting this requirement, but it still offers a path to unified reporting.

Versus EU Corporate Sustainability Reporting Directive (CSRD)

The CSRD also has a broad extraterritorial reach and requires comprehensive ESG reporting, including Scope 3 emissions and adherence to “double materiality”.

While there is overlap, particularly for multinational corporations, differences in specific metrics and reporting thresholds will require careful navigation.

The “Climate Policy…” document notes that these varied standards aim to create a level playing field.

CARB has acknowledged the importance of these comparisons and the stakeholders’ desire for interoperability, noting the challenge of adapting voluntary standards into legally robust California regulations.

Technical and Operational Challenges: Refrigerant Leaks, HVAC Systems, and Quality Assurance

A significant technical challenge for companies is detecting and managing refrigerant leaks in HVAC systems.

Low coolant levels can lead to inefficient cooling, higher humidity, and evaporator coil freezing, reducing energy efficiency and increasing operational costs.

A blocked drain pan is another sign of system malfunction related to refrigerant issues, as it can cause water to puddle on the floor and lead to further system problems.

Detecting and addressing such defects within the first year of system installation or operation is crucial for quality assurance and long-term performance.

Embracing a New Standard of Climate Accountability

The May 29, 2025, CARB stakeholder workshop illuminated the significant journey ahead for both the agency and reporting entities in implementing California’s pioneering Climate Accountability Package.

These laws, SB 253 and SB 261, are set to redefine corporate transparency by embedding climate impacts and risks within a framework that aspires to the rigor and verifiability of financial reporting.

This shift aims to combat greenwashing, empower stakeholders with reliable information, and drive substantive corporate action on climate change.

For affected companies, the path forward requires immediate and diligent preparation.

This includes establishing robust systems for comprehensive emissions data collection, focusing on direct Scope 1 sources like often-overlooked refrigerant emissions and the broad Scope 3 value chain, and preparing for rigorous third-party assurance.

It demands a strategic approach to identifying and managing climate-related financial risks in alignment with TCFD principles and fostering unprecedented levels of internal collaboration and board-level oversight.

While CARB navigates the complexities of finalizing detailed regulations by its year-end 2025 target, and the July 1, 2025, guideline deadline appears unachievable, the statutory reporting timelines for companies remain fixed.

This dynamic underscores the necessity for businesses to actively engage in CARB’s iterative rulemaking process, contributing to developing practical and effective standards.

By embracing this new era of transparency and accountability, companies can ensure compliance and unlock opportunities for operational improvement, enhanced risk management, and more credible, data-driven dialogue with all stakeholders, solidifying California’s role as a global leader in corporate climate responsibility.

The Evolving Landscape of Climate Accountability in California

California continues to set the pace for climate action in the United States, with its Climate Accountability Package representing a bold step toward increasing transparency and driving meaningful change.

As the state’s landmark disclosure requirements come into effect, companies operating in California face a new era of climate-related financial disclosures and risk management.

The package compels businesses to assess and disclose their climate-related financial risks, greenhouse gas emissions, and sustainability strategies, ensuring that climate-related risks are integrated into core business decisions.

With the implementation date fast approaching, companies must take proactive steps to understand their disclosure requirements, evaluate their climate-related risks, and develop robust sustainability strategies.

By doing so, businesses can stay ahead of regulatory changes, ensure compliance, and demonstrate accountability despite growing expectations around climate change and corporate responsibility.

Understanding Emissions Obligations Under the Climate Accountability Package

Under the California Climate Accountability Package, companies with annual revenues exceeding $500 million are required to disclose their greenhouse gas emissions and climate-related financial risks publicly.

This comprehensive mandate covers emissions from direct operations, supply chains, and products, as well as the identification and disclosure of climate-related risks and opportunities.

Companies must also outline their sustainability strategies, including any use of voluntary carbon offsets and ongoing efforts to reduce emissions.

The California Air Resources Board (CARB) reviews these reports, ensures compliance, and provides guidance to help companies align their efforts with state climate goals.

By thoroughly understanding their emissions obligations, companies can meet regulatory requirements and enhance their sustainability performance, reduce their environmental impact, and strengthen their accountability to stakeholders.

Proactive compliance and transparent reporting are essential for companies seeking to lead in California’s evolving climate landscape.

The Role of Refrigerant Leaks in Emissions Reporting

Refrigerant leaks represent a significant, yet often underappreciated, source of greenhouse gas emissions within many industries, especially those reliant on cooling and refrigeration systems.

Releasing refrigerants such as Freon from air conditioning units and refrigeration equipment contributes directly to climate change due to their high global warming potential.

Under the California Climate Accountability Package, companies must report on refrigerant leaks as part of their emissions disclosures, detailing the quantity of refrigerant released, the sources and causes of leaks, and the measures taken to prevent and repair them.

By addressing refrigerant leaks, companies fulfill their regulatory obligations and demonstrate a commitment to sustainability and environmental stewardship.

Proactive efforts to monitor, report, and reduce refrigerant emissions are essential for improving overall sustainability performance and meeting California’s rigorous accountability standards.

Identifying Causes and Signs of Refrigerant Leaks

Detecting and addressing refrigerant leaks is critical to effective emissions management and sustainability strategies.

Common causes of refrigerant leaks include:

- Damage or corrosion to evaporator coils,

- Worn seals,

- Loose fittings, and;

- General system malfunctions.

Warning signs that may indicate a refrigerant leak include:

- Hissing or bubbling noises from the AC unit,

- Warm air coming from vents instead of cool air, and;

- A noticeable increase in indoor humidity.

Companies should implement proactive steps such as regular inspections, maintenance of air conditioning and refrigeration systems, and routine checks of refrigerant levels.

Inspecting coils and vents for visible damage, ensuring the system has enough refrigerant, and promptly repairing or replacing faulty components are essential practices.

By identifying and addressing refrigerant leaks early, companies can reduce their greenhouse gas emissions, improve system efficiency, and enhance their overall sustainability performance.