Readiness for GHG Emissions Reporting: Why Grocery Outpaces Data Centers in Compliance

The grocery and data center industries rely heavily on cooling systems, significant contributors to Scope [1] GHG emissions.

However, the grocery sector is stronger in refrigerant management and reporting than the data center industry.

On November 5, 2024, a federal court upheld California’s landmark climate disclosure laws, S.B. 253 and S.B. 261, by denying a motion to invalidate them on First Amendment grounds. This decision solidifies the laws’ status as the only comprehensive U.S. mandates for climate-related disclosures amid uncertainty about federal rules under the incoming administration.

The laws require large companies to disclose Scope 1 and 2 emissions and prepare for Scope 3 reporting, emphasizing transparency in environmental impact. Companies must prioritize closing gaps in their current practices to align with the requirements, particularly for Scope 1 refrigerant emissions under S.B. 253, which takes effect in 2025. This ruling underscores the importance of proactive compliance as California leads the way in climate accountability. The grocery and data center industries rely heavily on cooling systems, yet their approaches to managing refrigerant emissions reveal stark differences. As regulatory and shareholder pressures mount, the grocery sector emerges as a leader in emissions reporting and management while data centers lag, raising concerns about their readiness for regulatory scrutiny. This gap impacts environmental outcomes, and highlights missed opportunities for operational excellence in data center operations.

Why is SB 253 important?

Mandatory Reporting

- Corporations with annual revenues exceeding $1 billion must report their GHG emissions, including Scope 1 (direct emissions) and Scope 2 (indirect emissions from energy use).

- Scope 3 (indirect emissions from the value chain) will also require reporting starting in 2027.

Third-Party Assurance

Reports must undergo third-party verification to ensure accuracy and compliance.

Public Disclosure

Companies must publicly disclose emissions data, enhancing transparency and driving accountability.

Scope 1 Emphasis

High-GWP substances, such as refrigerants, are a primary focus of Scope 1 reporting, requiring companies to track and manage fugitive emissions from leaks and servicing.

Demands of California S.B. 253

California’s Climate Corporate Data Accountability Act (S.B. 253) is a regulatory framework that requires large corporations to disclose their greenhouse gas (GHG) emissions to ensure accountability and progress toward climate goals. The law emphasizes comprehensive transparency across all emissions scopes (Scope 1, 2, and eventually Scope 3), with specific attention to regulated substances like refrigerants in Scope 1.

By mandating these requirements, S.B. 253 holds companies accountable for their climate impacts while aligning corporate practices with investor and societal expectations.

Table of Contents

ToggleRefrigerants: A Strategic Imperative in Scope 1 Emissions Management

Refrigerants represent both a challenge and an opportunity in managing Scope 1 emissions. Their high global warming potential (GWP) makes effective management critical for environmental sustainability, compliance, and cost-efficiency.

Refrigerants in Scope 1 Emissions

Scope 1 emissions include direct GHG emissions from owned or controlled sources. For grocery retail, data centers, and manufacturing industries, refrigerants are often the largest contributors due to leaks during cooling system operation, maintenance, or disposal.

The Impact of GWP

Refrigerants such as R-410A and R-134a demonstrate the outsized impact of leaks:

- R-410A: With a GWP of 2,100, a single kilogram leak equals the impact of 2.1 metric tons of CO₂.

- R-134a: With a GWP of 1,430, this common refrigerant is over a thousand times more potent than CO₂.

Example:

A grocery store with 500 kilograms of R-410A and a 20% annual leak rate (average) would release 100 kilograms, equivalent to 210 metric tons of CO₂ emissions—the same as driving over 520,000 miles.

The Stakes: Environmental and Operational Impacts

Environmental Risks

- GHG Contribution:

- Refrigerant leaks majorly contribute to Scope 1 emissions, undermining corporate climate goals.

- Long-Term Effects:

- High-GWP refrigerants exacerbate global warming, persisting in the atmosphere for decades.

- Traditional refrigerants are being phased out and will essentially be obsolete in 13 years, 20 years before the equipment installed in Data Centers is fully depreciated.

Operational Challenges

- Rising Costs:

- Leaks increase refrigerant replenishment expenses and energy consumption as cooling systems lose efficiency.

- Regulatory Compliance:

- S.B. 253 and the Kigali Amendment impose stringent leak detection, repair, and reporting requirements, with non-compliance potentially leading to administrative penalties.

Cooling Systems Under Pressure: Comparing Refrigerant Management in Grocery Stores and Data Centers

Grocery stores and data centers rely heavily on cooling systems, making refrigerant management a critical operational and environmental priority. However, their differing dependencies, regulatory pressures, and transparency levels reveal contrasting approaches that offer efficiency, compliance, and sustainability lessons.

Cooling Dependency

Grocery stores rely on refrigeration to preserve perishables, making refrigerants a dominant contributor to Scope 1 emissions. Meanwhile, data centers depend on cooling to maintain server temperatures, focusing more on energy efficiency than refrigerant oversight.

Regulatory and Stakeholder Pressures

Grocery stores align closely with EPA refrigerant rules and frameworks like California’s S.B. 253. At the same time, data centers face increasing scrutiny to address often-overlooked refrigerant emissions as part of their Scope 1 footprint.

Transparency Gaps

Advanced refrigerant tracking gives grocery stores an edge in compliance, whereas data centers lag in disclosures, creating a significant gap in sustainability practices.

As data storage demand surges and grocery operations remain critical, comparing these industries highlights the universal need for improved refrigerant management to achieve environmental and operational excellence.

The Grocery Industry Leads

Operational Focus

Refrigerant management in the grocery sector is a core operational necessity. Companies like Walmart report that refrigerants account for ~50% of Scope 1 emissions, while Kroger identifies ~63%, driving direct efforts to manage leaks and improve sustainability.

Transparency

Detailed refrigerant data and third-party assurance from leaders like Walmart ensure compliance with regulations like S.B. 253.

Economic and Environmental Gains

Lower refrigerant leaks reduce emissions, cut costs, and improve cooling efficiency, creating a trifecta of regulatory compliance, shareholder alignment, and financial performance.

Data Centers Lag Behind

Refrigerant Overlooked

Data centers prioritize Scope 2 energy efficiency over Scope 1 refrigerant management, leaving emissions from leaks largely unaddressed.

Lack of Transparency

Companies like NetApp claim a 70% reduction in GHG intensity but fail to disclose foundational data, raising doubts about their readiness for regulatory scrutiny.

Compliance Challenges

Without detailed disclosures or robust lifecycle tracking, data centers risk failing to meet regulatory and shareholder expectations.

Key Takeaway

The disparity between grocery and data center readiness underscores the need for proactive engagement. Industries that embrace comprehensive refrigerant management and emissions reporting gain operational, environmental, and reputational advantages, positioning themselves for success in a sustainability-driven future.

The Strategic Case for Refrigerant Management

Managing refrigerants effectively transforms a compliance challenge into a strategic advantage, delivering environmental, operational, and reputational benefits.

Key Benefits

Compliance and Shareholder Alignment

Proactive refrigerant management meets regulatory demands like S.B. 253 and satisfies investor expectations for transparent ESG reporting.

Cost Efficiency and Operational Excellence

Leak detection and repairs reduce the need for expensive refrigerant replenishment and optimize cooling system efficiency.

Sustainability and Brand Leadership & managing related regulatory risks

Companies excelling in refrigerant management enhance their reputation as sustainability leaders, aligning with global climate commitments and avoiding the expense of costly regulatory investigations that often result in failure, fines, and loss of stock value.

EPA AIM Act and SB 253: A Cross-Over Strategic Imperative

Refrigerants are no longer just an operational necessity but a strategic priority in Scope 1 emissions management. Companies that proactively manage refrigerants can:

Reduce emissions

align with regulations like S.B. 253, and meet stakeholder expectations.

Optimize operations

by reducing leaks, improving efficiency, and cutting costs.

Lead in sustainability

positioning themselves as innovators and stewards of environmental responsibility.

The EPA requires precision and accountability in addressing refrigerant emissions, but this can help organizations improve performance and meaningfully contribute to a low-carbon future. Through effective refrigerant management, businesses can transition from reactive compliance to proactive leadership, creating lasting value for stakeholders and the planet.

Readiness for GHG Emissions Reporting: Key Differences Between Grocery and Data Centers

| Aspect | Grocery Industry (Walmart, Kroger) | Data Center Industry (Digital Realty, NetApp, Target) |

|---|---|---|

| Cooling Dependency | Refrigeration for food preservation | Cooling for server temperature management |

| Scope 1 Focus | High (refrigerant leaks dominate emissions) | Moderate (Scope 2 energy use prioritized over refrigerants) |

| Refrigerant Contribution | Walmart: ~50%, Kroger: ~63% of Scope 1 | Rarely disclosed; refrigerants largely unreported |

| Transparency | Detailed refrigerant data available | Limited public refrigerant disclosures |

| Third-Party Assurance | Walmart: Yes, Kroger: No | Rarely provided |

| Regulatory Readiness | Strong (experience with refrigerant tracking) | Lagging (focused on energy metrics, lacking refrigerant data) |

Assessing readiness for change is crucial in behavior change, sustainability, and climate change. By doing so, they can comply with regulatory standards and contribute to broader climate change mitigation efforts. Over the past decade, data centers have seen significant investment due to the increasing demand for digital data storage and management.

Understanding Emissions Reporting

Emissions reporting is a cornerstone of any company’s sustainability strategy, especially in the face of escalating climate change concerns. This process involves meticulously measuring, reporting, and verifying greenhouse gas (GHG) emissions, significantly contributing to global warming. Accurate emissions reporting is not just a regulatory requirement; companies need to understand their carbon footprint, pinpoint areas for reduction, and devise strategies to mitigate their environmental impact.

Emissions reporting is crucial for data centers due to the substantial energy consumption required to power these facilities. Data centers are responsible for a notable share of global GHG emissions, making it imperative for companies in this sector to prioritize emissions reporting and reduction. By doing so, they can comply with regulatory standards and contribute to broader climate change mitigation efforts.

Detailed Insights

Grocery Industry GHG Emissions

Walmart

- Walmart reported 14.2 MtCO₂e in total GHG emissions for 2022, with approximately 50% attributed to Scope 1 activities, primarily refrigerant leaks and fuel use.

- Walmart’s commitment to third-party assurance ensures accurate and reliable reporting, aligning with S.B. 253 requirements.

Kroger

- In its 2023 ESG report, Kroger disclosed 1,337,488 metric tons of CO₂ equivalent from refrigerant-related Scope 1 emissions, representing ~63% of its total Scope 1 emissions.

- However, Kroger’s lack of third-party assurance introduces skepticism about the accuracy and completeness of its disclosures, especially regarding unreported refrigerant leaks or exclusions.

Data Storage Center Industry

Digital Realty

- Digital Realty has committed to reducing Scope 1 and Scope 2 emissions by 68% by 2030, based on a 2018 baseline.

- Digital Realty operates multitenant data centers, in which companies lease space within the facility. This arrangement allows the data center operator to manage the building and essential infrastructure while end users maintain their servers in the leased areas.

- The readiness for change in emissions reporting can vary based on specific behavior. Some companies are more prepared to address energy efficiency, while others may struggle with refrigerant management.

- However, specific refrigerant-related emissions data is not disclosed, suggesting a lack of transparency in Scope 1 reporting. The primary focus remains on energy efficiency (Scope 2).

NetApp

- NetApp reports a 70% reduction in GHG intensity over six years, but foundational data supporting this claim is unavailable.

- The absence of refrigerant-specific Scope 1 emissions data raises doubts about the credibility of these reductions, especially given the high reliance on cooling in data centers.

Anonymous Retail Corporation

- An anonymous but large nationwide retailer recently reported that Scope 1 emissions for 2023 are significantly lower than those of Kroger and Walmart. This disparity suggests potential underreporting or reliance on exclusions, particularly for refrigerant emissions; this behavior is normal and will continue until assurance and reporting are standardized.

- The nationwide retailer also lacks detailed breakdowns or third-party assurance, further reducing the credibility of its disclosures under S.B. 253.

The Growing Need for Cooling.

How Data Growth Drives Environmental Impact in Data Centers?

As digital data storage expands, the demand for cooling systems in data centers rises proportionally, intensifying their environmental impact. Data centers consume vast energy to maintain optimal server temperatures and produce significant greenhouse gas (GHG) emissions.

Data centers are adopting sustainable practices such as renewable energy, energy-efficient cooling systems, and advanced technologies like artificial intelligence to optimize energy use to mitigate these effects. However, the more data we generate and store, the greater the challenge becomes—balancing the need for efficient data management with comprehensive emissions reporting and compliance. Addressing this challenge is essential to ensuring both operational growth and environmental responsibility.

Assessing Readiness for Change

Assessing readiness for change is a pivotal step towards effective emissions reporting and overall sustainability. James O. Prochaska’s Transtheoretical Model of Change provides a useful framework for understanding this process. It outlines six stages of behavior change: pre-contemplation, contemplation, preparation, action, maintenance, and termination.

In emissions reporting, assessing readiness involves evaluating an organization’s motivation, willingness, and capacity to reduce its GHG emissions. This can be achieved through various methods, including surveys, interviews, and focus groups. Motivational interviewing, in particular, is a valuable tool in this context. It helps to uncover an organization’s or individual’s motivation and readiness to make the desired change. For example, an organization may be prepared to adopt new practices like energy-efficient operations while still struggling to stop smoking in the workplace.

By understanding where an organization stands in the stages of change, tailored strategies can be developed to support and facilitate the transition toward comprehensive emissions reporting and reduction. This approach ensures that efforts align with the organization’s current state, enhancing the likelihood of successful and sustained change.

Behavior Change and Emissions Reduction

Behavior change is a pivotal element in the quest to reduce greenhouse gas (GHG) emissions and combat climate change. Both individuals and organizations must recognize the significance of evaluating their motivations and readiness for change to foster sustainable practices. The Transtheoretical Model of Change, developed by James O. Prochaska, offers a comprehensive framework for understanding behavior change. This model outlines six stages: pre-contemplation, contemplation, preparation, action, maintenance, and termination.

Understanding these stages is crucial for creating effective strategies to reduce emissions. For instance, in the pre-contemplation stage, individuals or organizations may not yet recognize the need for change. Moving into the contemplation stage, they begin acknowledging the problem and considering the benefits of change. Preparation involves planning and committing to action, while the actual behavior change occurs in the action stage. Maintenance focuses on sustaining the new behavior, and termination signifies the point at which the new behavior is fully integrated and no longer requires effort to maintain.

Behavior change can significantly impact GHG emissions in the context of data centers. Data centers are energy-intensive operations, and adopting more energy-efficient practices can lead to substantial emissions reductions. For example, data centers can transition to renewable energy sources, which reduce carbon footprints and align with global sustainability goals. Additionally, implementing sustainable cooling systems and reducing water consumption is critical to minimizing environmental impact.

Assessing motivations and readiness for change is essential in this process. Data centers must evaluate their current practices, identify areas for improvement, and develop a clear roadmap for achieving their sustainability goals. This might involve conducting energy audits, investing in new technologies, and engaging stakeholders in the change process. By understanding where they stand in the stages of change, data centers can tailor their strategies to ensure successful and sustained emissions reductions.

Ultimately, behavior change is not just about adopting new practices but about fostering a sustainability culture. By committing to continuous improvement and innovation, data centers can significantly reduce their GHG emissions and contribute to a more sustainable future. This proactive approach benefits the environment, enhances operational efficiency, and aligns with regulatory and shareholder expectations.

Creating Readiness for Emissions Reporting

Creating readiness for emissions reporting involves a multifaceted approach designed to support and facilitate the change process. This includes providing professional advice and guidance, offering targeted training and education, implementing robust policies and procedures to support emissions reduction, and fostering stakeholder engagement to raise awareness and build support.

For data centers, this might involve adopting energy-efficient technologies, such as renewable energy sources, and developing strategies to minimize energy consumption. Engaging with stakeholders—including employees, customers, and suppliers. Raising awareness and building support for emissions reduction efforts can drive collective action and commitment.

Organizations can effectively meet their sustainability goals by fostering readiness for emissions reporting. This proactive stance helps reduce environmental impact and supports positive change, contributing to a more sustainable future. Data centers can play a pivotal role in the global movement towards sustainability and climate resilience through these efforts.

Key Takeaways

Grocery Industry Leadership

- Grocery retailers, especially Walmart, strongly align with regulatory requirements through detailed refrigerant disclosures and third-party assurance practices.

- While Kroger is advanced in reporting, it must address the lack of assurance to improve the reliability of its disclosures.

Data Center Industry Challenges

- Data centers prioritize Scope 2 (energy) over Scope 1 (refrigerant emissions), creating significant transparency gaps.

- Claims of emissions reductions, such as NetApp’s 70% decrease in GHG intensity, lack foundational data and are difficult to verify without third-party assurance.

Regulatory Readiness

- Under California’s S.B. 253, grocery companies are better positioned to comply due to their experience with refrigerant tracking and reporting.

- Data centers, by contrast, must enhance their refrigerant data collection, transparency, and assurance practices to meet similar standards and avoid significant administrative penalties within the reporting year.

A Strategic Shift: Leaning Into Engagement

Organizations navigating refrigerant emissions management face a pivotal choice: adopt a defensive posture, narrowly focusing on avoiding penalties, or embrace a proactive strategy that unlocks broader benefits. Both approaches involve significant costs, but a proactive stance positions companies as leaders in compliance, sustainability, and operational innovation, maximizing opportunities for efficiency, stakeholder trust, and environmental impact.

Strategies and Supporting Tactics

1. Proactive Leak Detection and Repair

- Engagement Focus: Treat leak detection as a critical driver of reliability, cost savings, and emissions reduction.

- Tactics:

- Install Automatic Leak Detection (ALD) systems tailored to specific facility sizes and refrigerant types.

- Use real-time IoT-enabled sensors to monitor for leaks and anomalies.

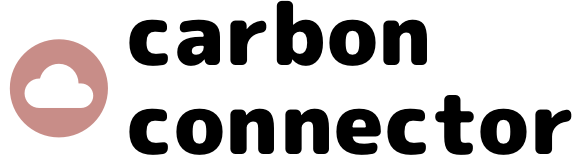

- Create a trained response team to address detected leaks, rapidly turning insights into immediate actions. You can outsource to a managed services company if you don’t have a trained team. We have evaluated and tested two leak detection options.

- Bueno-BARLO has an advanced software-based indirect leak detection technology that can detect leaks before they manifest significant losses with an impressive 85% effectiveness.

AKO is a direct leak detection system that provides a software/hardware solution based on NDIR.

It is 10 times more effective than existing old tech systems.

Value Proposition: Proactively reducing leaks improves system efficiency, decreases energy costs, and prevents operational disruptions.

2. Comprehensive Refrigerant Lifecycle Management

- Engagement Focus: View lifecycle accountability as an opportunity to reduce environmental impact and strengthen supply chain resilience.

- Tactics:

- Develop a lifecycle stewardship program to track refrigerants from acquisition through recovery and disposal.

- Promote the use of reclaimed refrigerants in servicing, reducing reliance on virgin materials.

- Partner with certified reclaimers to enhance refrigerant recovery and recycling quality.

- Value Proposition: Effective lifecycle management reduces emissions, minimizes waste, and builds resilience against supply chain volatility.

- Suggested Solution: Trakref is the only stand-alone software solution and, for 10 years, has provided a centralized platform to track refrigerants from acquisition through recovery, ensuring compliance and reducing emissions; it has withstood more than 2000 audits successfully. Its integration supports reclaimed refrigerants and partnerships with certified reclaimers to enhance recovery and recycling quality, building supply chain resilience.

3. Robust Recordkeeping, Reporting, and Collaboration

- Engagement Focus: Leverage reporting to create transparency and build trust with stakeholders and regulators.

- Tactics:

- Centralize data using platforms like Trakref to integrate records across internal teams and external contractors.

- Automate reporting processes to improve data accuracy and efficiency.

- Harmonize reporting standards to create a unified compliance framework, simplifying regulatory obligations.

- Value Proposition: Robust recordkeeping enhances transparency, simplifies compliance, and fosters stronger stakeholder relationships.

- Suggested Solution: Trakref centralizes refrigerant data, consolidating records across internal teams and contractors for transparency and accuracy. Its automated rules-driven reporting tools streamline compliance with S.B. 253 (as well as all HVAC/R regulations across the US) , while its guided framework harmonizes standards for seamless collaboration and regulatory readiness.

4. Updated Policies, Procedures, and Training

- Engagement Focus: Align organizational policies with long-term ESG goals and engage employees in achieving sustainability objectives.

- Tactics:

- Draft policies that integrate refrigerant management into broader ESG commitments.

- Provide regular training on regulatory updates, new technologies, and operational best practices.

- Tie measurable KPIs for refrigerant performance to incentives for employees and contractors.

- Value Proposition: Clear policies and well-trained staff ensure alignment with sustainability goals and build a culture of accountability.

5. Advanced Tracking, Tagging, and Labeling

- Engagement Focus: Use technology to improve refrigerant traceability and ensure lifecycle visibility.

- Tactics:

- RFID tags or QR codes can be applied to refrigerant cylinders and equipment for real-time tracking. They will soon be required.

- Standardize tagging and labeling across locations to eliminate inconsistencies.

- Integrate tracking systems with centralized platforms to ensure comprehensive data coverage.

- Value Proposition: Accurate tracking reduces waste, ensures regulatory compliance, and supports operational efficiency.

Offense Versus Defense Posturing: A Proactive Framework

Regulatory requirements like EPA standards and S.B. 253 make these practices increasingly mandatory. These updates become operationally necessary rather than aspirational by proactively integrating regulatory demands with shareholder expectations. An offense-oriented approach delivers tangible benefits, including cost savings, compliance, and sustainability leadership.

The Trifecta of Proactive Engagement

By adopting a proactive stance, organizations can achieve the trifecta of compliance, operational efficiency, and sustainability:

Avoid Regulatory Failures

Compliance with EPA and S.B. 253 requirements reduces the risk of fines, reputational harm, and operational disruptions.

Satisfy Shareholder Reporting Demands

Transparent refrigerant management aligns with ESG goals, meeting investor expectations for sustainability.

Lower Costs and Environmental Impact

Reduced refrigerant leaks lead to:

- Lower emissions and improved environmental performance.

- Decreased costs from reduced refrigerant replacement needs.

- Energy savings through improved system efficiency.

Why Offense is Better Than Defense

Sustainability as a Competitive Edge

Organizations leading in refrigerant management gain reputational and operational advantages, enhancing their market position.

Operational Excellence

Technology, training, and lifecycle management investments deliver better-performing systems and lower costs.

Future-Proofing

Proactive engagement ensures readiness for evolving regulatory landscapes, minimizing disruptions and fostering adaptability.

A Blueprint for Success

Organizations can transition from mere compliance to operational leadership through this engagement-focused framework. The grocery industry has proven to reduce refrigerant emissions, optimize lifecycle management, and align with sustainability goals, positioning companies as industry leaders and benefiting stakeholders, shareholders, and the environment.

While both industries depend on cooling systems, the grocery sector demonstrates superior refrigerant emissions management and regulatory readiness. In contrast, the data center industry lags in refrigerant transparency, focusing instead on energy efficiency metrics. Without detailed disclosures and third-party assurance, data centers face significant challenges in meeting S.B. 253’s requirements and accurately reporting their Scope 1 emissions.

#sustainability #environment, #greenhousegases, #climatetech, #cleanenergy, #SB253, #GHGemission, #refrigerantmanagement, #datacenter, #grocery, #californiaclimatedisclosurelaws, #corporateESG, #supplychain, #energyefficiency, #aimact